Datadog (NASDAQ:DDOG) continues to impress me with the first quarter earnings results.

While the stock has retreated since its recent highs, I think that Datadog is starting to look interesting as a beneficiary to an accelerated migration to the cloud as a result of growing adoption of AI.

I have written extensively about Datadog on Seeking Alpha, which can be found here, and continue to be optimistic and confident in the company’s future prospects.

For those who are new to the company, Datadog is a monitoring service for cloud-based infrastructure and applications, providing visibility into servers, apps, tools, and services through its platform, which offers dashboarding, visualization, and alerting.

The company is currently still run by its founder, Olivier Pomel and Alexis Lê-Quôc, serving as CEO and CTO respectively.

Beat and raise

1Q24 revenues came in at $611 million, up 27% from the prior year and accelerating one percentage point relative to the prior quarter. This was 4% ahead of consensus expectations.

Operating margins came in at 27% for the first quarter, landing 5 percentage points above consensus.

Free cash flows came in at $187 million, beating consensus expectations by 16%. Free cash flow margin was 30.6%, higher than market consensus of 27.3%.

While 2024 guidance was raised, they were raised to a smaller margin than the market was expecting, and to a smaller margin than the beat that we saw in the first quarter.

Revenue guidance for 2024 was raised by 1.4% to $2.6 billion at the midpoint, implying 22% revenue growth for the year.

Operating margin guidance was likewise raised by 9% to $595 million at the midpoint, implying 22.9% operating margin for 2024.

EPS guidance was likewise raised by 9% to $1.54 per share at the midpoint, implying 22.9% operating margin for 2024.

In my opinion, the first quarter results were strong, but to revise the guidance by the full extent of the first quarter beat would make achieving the guidance riskier.

I think that with this 2024 guidance, there is conservatism applied to ensure that management is able to confidently achieve the goals set for the year, and possibly for yet another beat and raise quarter towards the end of the year.

Growing platform adoption

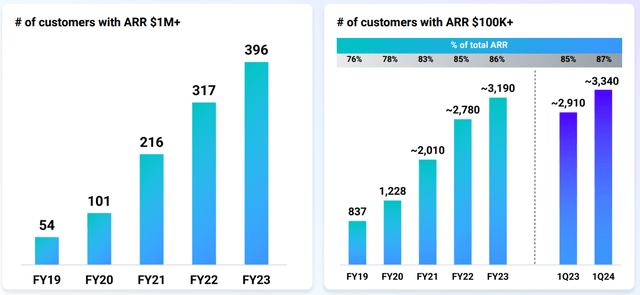

Customers with at least $100k in ARR grew 15% to 3,340 in the quarter. These customers make up 87% of Datadog’s total ARR and are thus very important customers.

Customers (Datadog)

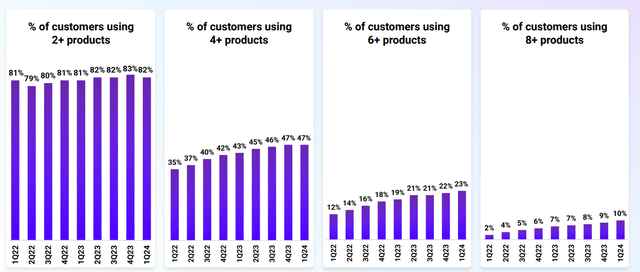

More importantly, the platform adoption continues to grow, with the percentage of customers using at least eight products growing from 7% last year to 10% in the quarter, the percentage of customers using at least six products growing from 19% last year to 23% in the quarter, and the percentage of customers using at least six products growing from 43% last year to 47% in the quarter.

Platform strategy (Datadog)

This comes as customers are increasingly not just adopting the older three pillars of observability, infrastructure monitoring, APM and log management, but also Datadog’s new products.

In fact, the products outside of observability, infrastructure monitoring, APM and log management currently contribute more than $200 million in ARR as of the first quarter.

There were 12 products that Datadog launched between 2020 to 2022. They now make up 11% of total ARR, and eight out of 12 of them are more than $10 million ARR products.

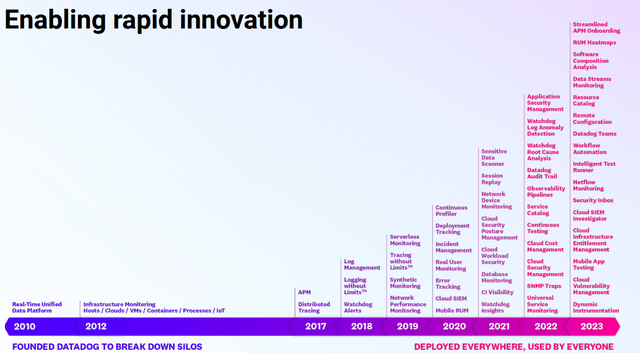

The amount of innovation and new products Datadog has launched is truly amazing, as can be seen below.

Datadog innovation (Datadog )

Database Monitoring product is already contributing 1% to revenue and growing quickly.

Cloud Cost Management is another newer product that has already exceeded $10 million in ARR. DevOps teams can now optimize their cloud spend across AWS, Azure and Google Cloud footprints by using Datadog’s Cloud Cost Management product.

Flex Logs is another product that has already exceeded $10 million in ARR, and it is actually still in limited availability. Flex Logs allows customers to scale storage and compute separately, enabling high volume use cases in a cost-effective manner. Management is seeing strong interest from customers thus far with Flex Logs and this looks like another promising new product for Datadog.

There was also steady AI growth with continued innovation. Next-generation AI customers now constitute 3.5% of total ARR, slightly ahead of last quarter’s 3%. Datadog also shared that 2,000 of its customers are using one or more of the company’s AI integrations to pull their AI data into the Datadog platform. Management remains committed to the opportunity and is keeping up with the rapid innovation in the space, recently adding a new integration with Nvidia’s Triton inference server in the quarter.

In the generative AI space, Datadog announced the general availability of Bits AI for Incident Management. Bits AI can be used for incident management, where incident responders will get an auto-generated incident summary to understand the context and scope of a complex incident. Bits AI can also be used to ask about relative incidents and to perform tasks like incident creation to resolution.

While still early days, these newer products look promising and will provide Datadog with a longer growth runway and grow its platform.

Market outlook

In the first quarter, Datadog saw usage growth from existing customers was higher than in the fourth quarter, and similar to what the company saw in the second and third quarter of 2022. During these two quarters, there was a normalization of usage after a very strong growth in usage that Datadog saw in 2021.

This growth was healthy across its product lines and naturally, the newer products grew faster.

In terms of the optimization that Datadog is seeing, the company is seeing the optimization activity reduce in intensity, although some customers continue to be cost-conscious.

There are a few green shoots in my view.

Firstly, the optimizing cohort that Datadog identified a few quarters before actually grew sequentially again this quarter.

Secondly, Datadog is seeing customers not just adopting more products on the platform, but also increasing their usage with the company.

I think this does illustrate that Datadog is winning in the cloud migration journey, given customers are consolidating point solutions into the Datadog platform.

Lastly, churn continues to be low, with gross revenue retention stable in the range of mid to high 90 percentage range.

While there was improved usage growth in the quarter and optimizations looked to be less of a headwind, there are still some concerns about overall IT spending given that many software companies saw a more measured buying environment in the first quarter.

My view is that in the long-term, Datadog will continue to benefit from cloud migration and with growing adoption of AI, this will only accelerate this trend, and with time, lead to usage growth that benefits Datadog.

In the JPM conference, CEO Olivier Pomel mentioned that it does not take a lot of imagination for Datadog to see that the core observability business can grow to five times or 10 times its current size. Given that the company now only commands a portion of the market, and that the IT Operations Management market is expected to grow about 10% to 11% over the next few years, and the cloud services market is expected to grow about 20% over the next few years.

As such, when you put the growth of the markets along with the fact that Datadog has been a consistent share gainer over the last decade, it does not take too much imagination to imagine that the business could grow to five times or 10 times its current size.

Overall, I think that while it is good that Datadog is not just seeing a stabilization but also a smaller acceleration, it is not quite reaching the massive acceleration that the market expects just yet.

That said, I think that there is an underestimation of what the growth is going to be in the medium to the long-term.

Winning new deals and expanding with existing customers

Datadog has been executing well in not just landing new customers, but also rapidly expanding and consolidating spend with existing customers. As you will see in greater detail in the examples below, existing customers usually grow their usage of Datadog products over time, demonstrating the strength of the land-and-expand model.

In a six-figure expansion deal with the European division of one of the largest automotive makers in the world, this customer currently monitors a quarter of their applications with Datadog and will be moving to 100% of their applications being monitored by Datadog in the next two years and also expand to use eight products on the platform.

In another seven-figure expansion deal with a leading online grocery business, the customer added seven more products including Cloud Security Management, Application Security Management, and Cloud SIEM, bringing the total number of products used on the Datadog platform to 14.

In yet another seven-figure expansion deal with a medical device company, while the customer initially only primarily used the infrastructure monitoring and APM suite, the customer is expanding to adopt nine products and consolidate not just its log management tool but also four other commercial and cloud native tools with Datadog. This comes as its legacy logging solution was not cost effective and performing as well.

The last expansion deal is a six-figure deal with an athletic apparel company that consolidated four commercial and open-source point solutions with Datadog, saving millions of dollars over the next few years and improving customer experience.

For land deals, Datadog landed a six-figure deal with a Fortune 500 industrial company that was moving its e-commerce application to Google Cloud and moving away from on-premises monitoring tools to keep up with the modern cloud environment.

Lastly, Datadog landed a six-figure deal with one of the world’s largest communication infrastructure companies, adopting seven Datadog products for now and consolidating four tools. As the company migrated to the cloud a few years ago, it was limited by fragmented tooling and a lack of data correlation, which Datadog is able to address by bringing a centralized observability across the business.

Valuation

I have revised the 2024 numbers to reflect the updated guidance, although I think there is also a high probability that Datadog will likely beat the 2024 guidance.

I assumed a 21% revenue CAGR and 25% EPS CAGR. Given the huge market opportunity, along with the strong growth profile of Datadog, this is then accompanied by improving operating margin and free cash flow generation, which helps to put it in the best-of-breed category.

Summary of my 5-year financial forecasts for Datadog (Author generated)

The intrinsic value for Datadog is based on a discounted cash flow model, assuming 50x 2028 terminal multiple and 12% discount rate.

As a result, I derive an intrinsic value of $121 for Datadog and I would enter Datadog at $97, based on a 20% discount to its intrinsic value to offer some margin of safety.

My 1-year and 3-year price targets for Datadog are $132 and $177. They imply 65x 2025 and 55x 2027 P/E.

Conclusion

I continue to like Datadog as a leading provider of monitoring and security for public, private cloud and on-premises applications, and increasingly, we are seeing Datadog win in platform consolidation deals.

While it remains early, I do think that the market is underestimating the medium to long-term growth potential for Datadog here. When

Overall, I think that while it is good that Datadog is not just seeing a stabilization but also a smaller acceleration, it is not quite reaching the massive acceleration that the market expects just yet.

That said, I think that there is an underestimation of what the growth is going to be in the medium to the long-term.

Datadog should see acceleration coming in sometime in the second half or in the calendar year 2025, as more workloads are migrated to the cloud, which is accelerated in part due to the growing adoption of AI.

Read the full article here