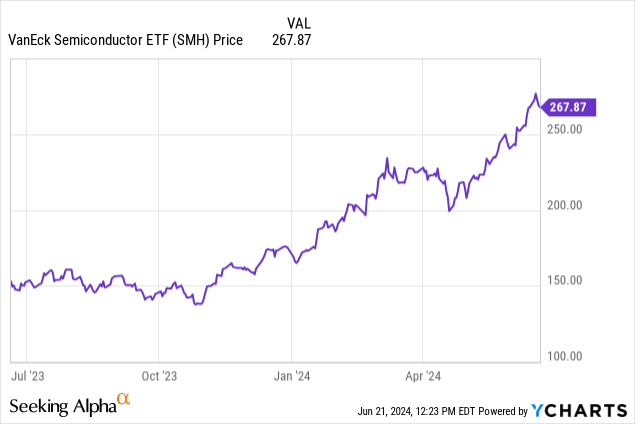

Since I covered the VanEck Semiconductor ETF (NASDAQ:SMH) in June 2023 in my bullish piece entitled “SMH ETF: The Nvidia Effect And De-Risking of the Supply Chain”, it has surged by more than 80% and is now trading at nearly $268 as charted below.

However, a correction is possible for the ETF whose AUM or assets under management are valued at nearly $25 billion. Thus, based mainly on a shift of the AI theme which has up to now predominantly benefited chips to start positively impacting software stocks, this thesis will show that SMH is a hold. For this purpose, I will compare it with the iShares Expanded Tech-Software Sector ETF (IGV).

There is also an issue that has appeared for the AI PC (or a personal computer or laptop which is driven by a processor specially designed for artificial workloads), which shows that there may not be the same level of demand as for servers hosted in data centers. This could in turn put into question the demand for underlying chips.

First, I highlight the reasons for VanEck’s ETF appreciation with the intent of showing how things could change.

How AI Has Helped SMH

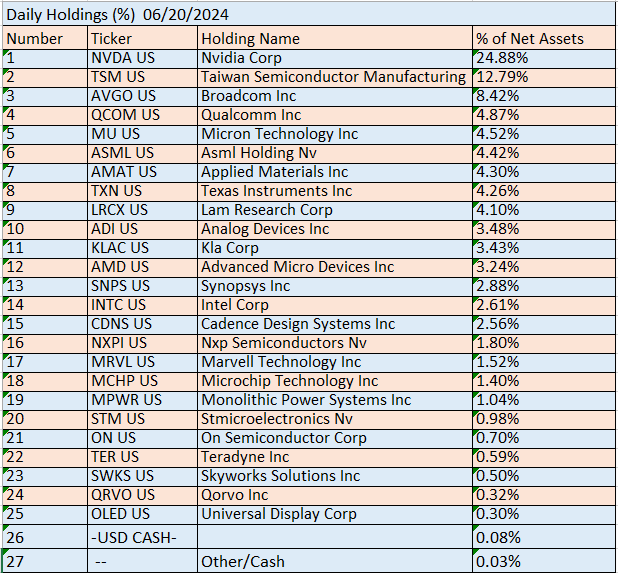

SMH is not just another tech ETF like the Technology Select Sector SPDR Fund ETF (XLK). The reason is except for a few software plays like Synopsys (SNPS) and Cadence Design Systems (CDNS) which are specialized in designing work for the industry, it exclusively holds chip stocks.

Its insane growth has been made possible not only because of top-holding Nvidia continually generating or guiding more sales than expected but also because its gross margins expanding in the process, implying pricing power. The reason the company can command much higher prices is its accelerator GPU chips deliver parallel processing fast enough to enable intelligent applications like ChatGPT which is one of the most popular applications in the world today, to function optimally.

www.vaneck.com

As for SMH’s second holding, Taiwan Semiconductor Manufacturing (TSM), it comes as no surprise that it is also gaining as it not only manufactures Nvidia’s chips but also those by its competitor Advanced Micro Devices (AMD). Also, some of the geopolitical risks associated with its location only about 100 miles from China are being mitigated through diversification in other parts of the world including Japan and the U.S.

Moreover, since a server includes memory and connectivity in addition to GPU chips, other SMH’s holdings have been benefiting from AI-led sales including Micron (MU) and Broadcom (AVGO) respectively. Therefore, while it is highly concentrated in Nvidia and has tremendously benefited from its upside, the rally enjoyed by SMH has been relatively broad. However going forward, the question is whether this index fund which tracks the performance of the MVIS US Listed Semiconductor 25 Index (MVSMHTR) and charges 0.35% can maintain its upward momentum.

Well, semiconductors are the very backbone of modern electronic devices, or everything from smartphones, domestic appliances computers, and cars. Also, in addition to artificial intelligence, semis are crucial for the development and operation of emerging technologies like autonomous vehicles, robotics, and 5G networks.

Factoring in the Software

However, to launch intelligent applications whether it is in industries, automobiles, or for communication purposes, a lot of work is required from the time a server is installed in the data center and connected to the corporate data network. This involves training an AI model, a task that can consume from $10 million to $200 million. This range is more than one of Nvidia’s supercomputers which can cost from $7 million to $60 million. Moreover, according to research by Gartner covering IT spending for 2024, $914 billion should be spent on software or a growth of 13.9% YoY which is more than the combined expenses in data center systems and devices which should grow by 10% and 3.6% respectively.

Now, neither all of the software spending expected for this year will be dedicated to AI nor will data center clients buy only GPUs, but the take here is that the IT mix does not include solely hardware (in this case chips) but also software. Also, working with AI requires distinct competencies compared to conventional IT, and the work is normally planned well in advance as part of elaborate projects which means money is already been spent on software since Nvidia has been selling its accelerator chips for more than one year.

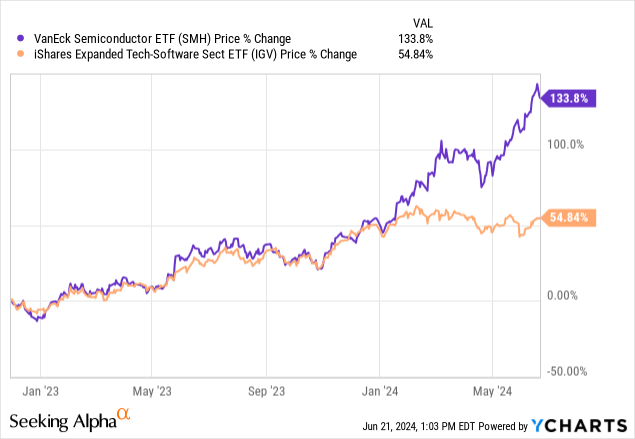

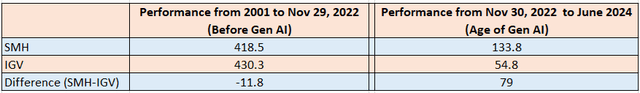

However, this spending logic is not reflected in the difference in performance between SMH and IGV, especially in the period spanning from November 30 2022 to currently when the semi-ETF has gained 177% while it is only 58% for software.

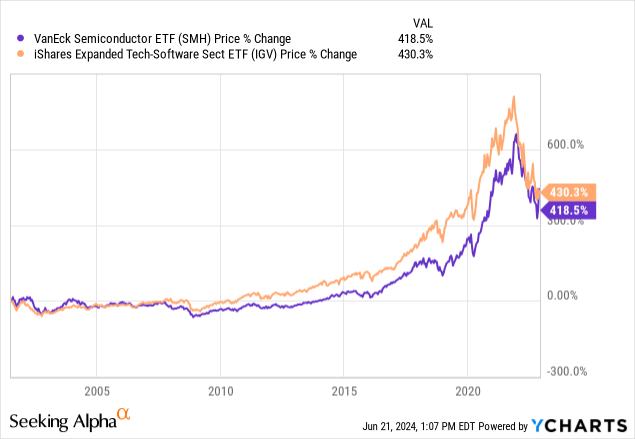

I chose November 30, 2022, the date ChatGPT was launched marking the start of the Generative AI age and the 79% performance difference between the two ETFs is in sharp contrast to the -11.8% in the 2001 to November 29, 2022 period. Thus, before the Gen AI age, it was IGV which outperformed by 11.8%.

The performance differences before and after the age of Generative AI are illustrated in the table below are illogical considering the normal mix of hardware and software in overall IT spending.

Semis Outperforming Software is Illogical

The table was prepared using data from (seekingalpha.com)

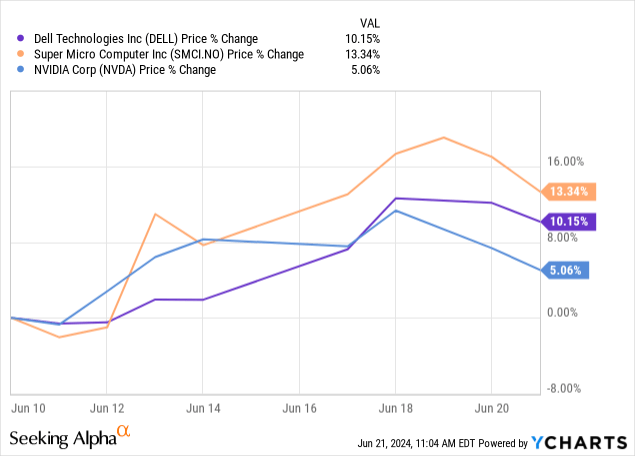

To address this discrepancy, there should normally be a rotation from hardware (semis) to software but this has been delayed for two reasons. Firstly, SMH has been indirectly benefiting from increasing demand for equipment from server manufacturers like Dell (DELL) or Super Micro (SMCI) for data centers. Some of the money flowing into these have also benefited chip stocks like Nvidia as shown in the chart below.

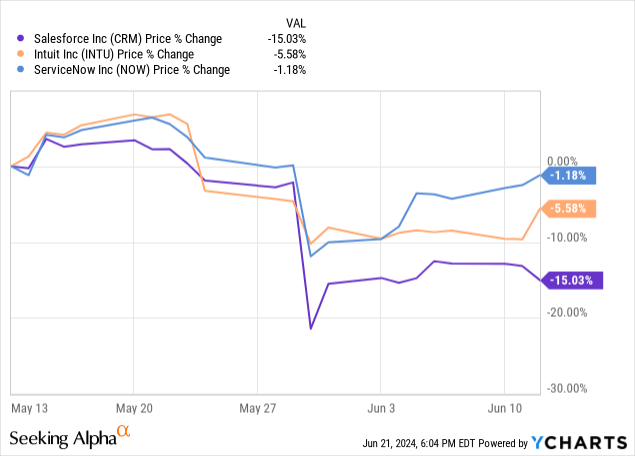

Secondly, money flows into AI should have benefited application software companies that lie next in the value chain after the server has been installed. While companies like Microsoft (MSFT) and Oracle (ORCL) are benefiting after beefing up their cloud infrastructures with AI chips many others including Salesforce (CRM), ServiceNow (NOW), and Intuit (INTU) have not. The reason is Gen AI is it also comes with disruption meaning that while some companies will benefit from more sales others are likely to see a loss in market share.

For Salesforce given its less-than-expected earnings report and lower revenue guidance, it seems that it has not yet seen benefits as I elaborated in a recent thesis. Also, at the time it reported financial results, the shares of other software plays were impacted as charted below.

However, to be realistic, AI can’t reach enterprises and consumers without the involvement of application software companies. This means that as companies like Salesforce adjust their product mix, they are likely to improve their financial results and attract inflows. This means that it is time to exercise caution when investing in SMH especially given that at a price-to-earnings of 29.21x, it trades at a 4.3% premium relative to its category average which shows the high level of expectations being priced by the market.

Risks Coming from AI PC

In this case, things could change in case investors’ moods turn sour during the big tech earnings season in the second half of July. While Nvidia is seeing pent-up demand from enterprises for its rapidly evolving roadmap which now boasts Blackwell GPUs, it only constitutes 24.9% of SMH, and things are not so rosy for the consumer side of things. In this respect, volatility engulfed the shares of Qualcomm (QCOM) which fell by about 5% following reports that laptops manufactured by Samsung (OTCPK:SSNLF) and using its AI processor were incompatible with some commonly used applications and PC games.

Now, this incompatibility issue hints at other problems, namely whether the software ecosystem is ready for the widespread deployment of AI PCs which are also relatively more expensive than conventional ones as they contain innovation. This may be why even though corporations are showing strong interest in AI PCs, some industry experts express reserves in terms of the real opportunities because of a lack of game-changing applications. Thus, sales may struggle to take off as consumers may not be willing to pay a premium unless purchasing an AI laptop means getting access to cutting-edge AI applications. However, many people can already interact with models like ChatGPT, Claude, and Perplexity AI using their existing laptops. Hence, the danger is that AI PCs may end up being bought as part of normal hardware upgrades instead of being acquired as part of a rapid technology refresh cycle as is normally the case for products benefiting from high demand.

As for enterprises, according to Forrester Research, the potential advantages of AI PCs may not be enough to convince CIOs to buy them because of priorities like cost, device management, and security. This may throw cold water on the enthusiasm displayed by PC vendors and chipmakers at the 2024 CES (Consumer Electronics Show) in Las Vegas early this year.

Looking further, other companies like AMD and Intel also produce AI chips for PCs which means that in case of unfavorable news, the ETF as a whole could suffer from volatility risks. Therefore, it is not the time to invest and to further support my position, according to Gartner, semiconductor sales should increase by 33% this year driven by Gen AI-related sales, but the problem is the VanEck ETF has already risen by 51.5%. In this respect, it is trading at a price-to-sale of 9.10x, or nearly two times its value during the same period last year.

Finally, the outperformance of chips relative to software since the advent of ChatGPT in the Gen AI age is illogical when compared with historical figures which implies that there should be a rotation, but given the big difference in performance as shown in the table above, expect volatility in SMH.

Read the full article here