Synopsis

Utz Brands (NYSE:UTZ) manufactures a wide range of branded salty snacks. UTZ’s past financials have shown robust net sales figures. In addition, its profitability margins have remained robust as well. In 1Q24, its power brands, especially its power four brands, showed strong retail sales and volume growth. For context, power brands make up 83% of its net sales. The net proceeds generated from its recent disposal of R.W. Garcia, Good Health, and five manufacturing facilities are being used to pay down debt. Combining this with its repricing of a term loan, they are expected to lower UTZ’s net leverage ratio and interest expense and also speed up its 3x net leverage target by one year. However, due to a lack of margin of safety in its current share price, I am recommending a hold rating.

Historical Financial Analysis

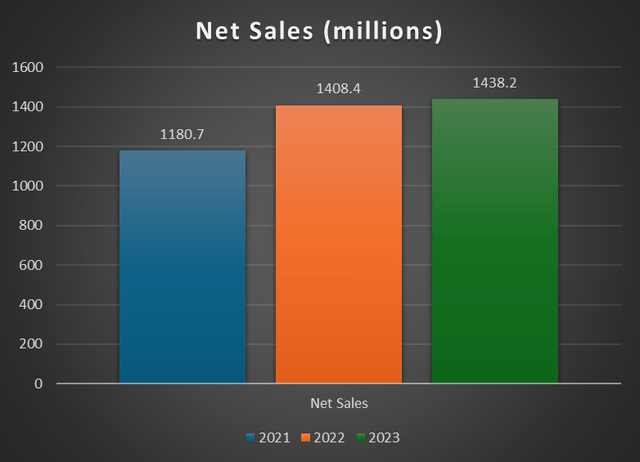

Author’s Chart

In 2022, UTZ reported net sales of approximately $1.408 billion, an increase from 2021’s reported net sales of $1.180 billion. This represents a year-over-year growth rate of 19.3%. On an organic basis, net sales growth was 15.5%. This strong double-digit growth rate was mainly driven by a favourable price mix. The favourable price mix was because of UTZ’s pricing action that began in the second half of FY2021 to combat inflation. In addition, organic increase in volume, distribution gains, and its acquisition of R.W. Garcia, Vitner’s, and Festida Foods also contributed to the strong growth.

In 2023, net sales continued to grow, as reported net sales were $1.438 billion vs. $1.408 billion in 2022. The growth in net sales was driven by the flow-through of pricing actions, partially offset by a volume mix decline due to SKU rationalisation.

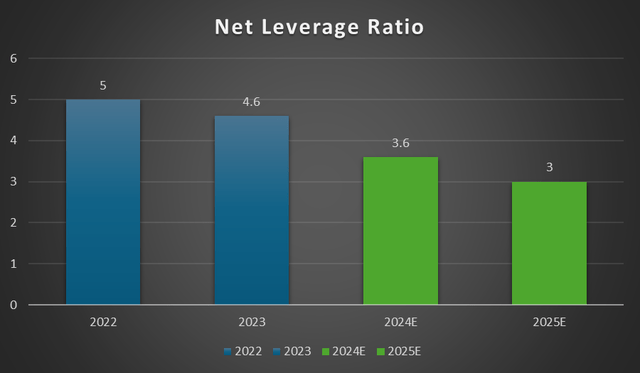

Regarding profitability margins, such as adjusted gross profit margin, adjusted EBITDA margin, and adjusted net income margin, all three of them remained robust throughout the same time period. In 2023, UTZ’s adjusted gross profit margin of 35.70% was in line with 2022’s 35.80%. Its adjusted EBITDA margin expanded from 12.10% to 13%, while its adjusted net income margin increased from 5.50% to 5.70%. Onto its net leverage ratio. In 2022, it reported a leverage ratio of 5x. In 2023, its net leverage ratio contracted to 4.6x. UTZ’s gross debt has been reduced from 2022’s $933.2 million to $918.7 million in 2023.

First Quarter Earnings Analysis

UTZ released its 1Q24 results on May 2, 2024. For the quarter, its net sales fell from $351.4 million to $346.5 million, which represents a 1.4% year-over-year decrease. Due to its recent disposals of Good Health and R.W. Garcia, they caused a 2.5% decrease in UTZ’s net sales. However, the decrease in net sales was partially offset by favourable volume mix and pricing. On an organic basis, net sales grew 1.5% year-over-year instead.

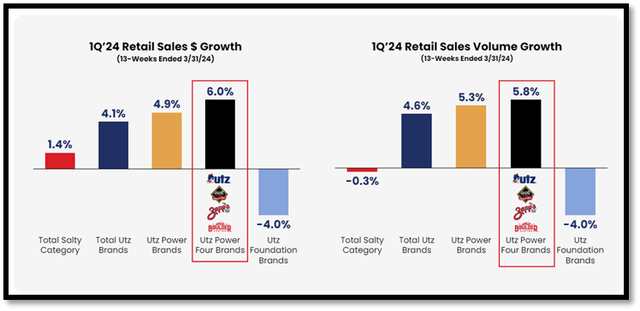

For UTZ, its net sales are assessed according to two classifications, which are power brands and foundation brands. UTZ’s power brands make up approximately 83% of its net sales, while the remainder is made up by foundation brands. For the quarter, total UTZ brand retail sales growth reported was 4.1%, and this growth was led by total UTZ brand volume growth of 4.6%. UTZ’s power brands retail sales growth reported was 4.9%, while UTZ power four brands retail sales increased by 6%. Overall, UTZ’s power brands, which make up the main portion of its total net sales, have shown strong growth for the quarter.

Investor Relations Author’s Chart

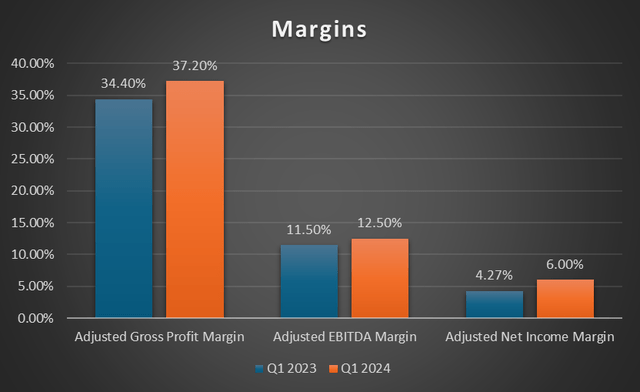

Moving onto profitability margins, all three margins expanded year-over-year. UTZ’s adjusted gross profit margin expanded from 34.40% to 37.20%. This expansion is driven by a favourable sales mix, increased pricing, and increased productivity. As a result of adjusted gross profit margin expansion, it benefited UTZ’s adjusted EBITDA margin as it expanded from 11.50% to 12.50%.

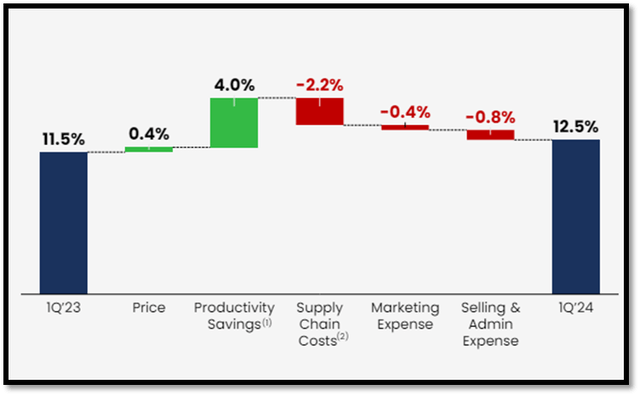

Looking at the following adjusted EBITDA margin bridge, pricing and productivity savings more than offset supply chain costs, marketing expenses, and selling and admin expenses. Lastly, its adjusted net income margin expanded from 4.27% to 6%. On an adjusted basis, EPS expanded from $0.11 to $0.14, which represents a growth rate of 27.3%.

Investors Relations

Disposals of R.W. Garcia and Good Health

Investors Relations

In February 2024. UTZ announced the disposal of three manufacturing facilities and two of its brands, which are R.W. Garcia and Good Health. These disposals are part of its network optimisation strategy and aim to simplify execution. This disposal generated a total consideration of $182.5 million, and after tax, the proceeds are approximately $150 million. This proceed is used by UTZ to pay down its long-term debt immediately.

The reduction in long-term debt is anticipated to reduce UTZ’s interest expense by around $12 million in FY2024. In addition, these disposals are also anticipated to speed up its 3x net leverage target by one year. UTZ is expected to achieve this target by FY2025 year-end.

Continuing Efforts to Reduce Net Leverage

Author’s Chart

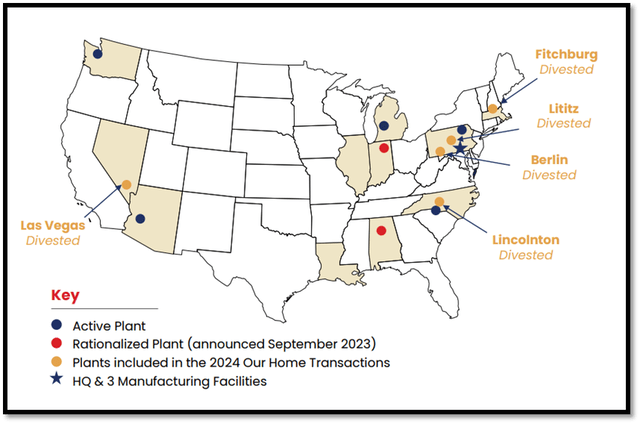

In its most recent quarter, UTZ continued to show its commitment to reducing net leverage as it closed the disposition of two more manufacturing facilities. These two manufacturing facilities are located in Berlin, Pennsylvania, and Fitchburg, Massachusetts. These disposals generated after-tax net proceeds of approximately $14 million, and the proceeds were used in two places. Firstly, $9 million of the proceeds were used to further pay down its long-term debt. $5 million, on the other hand, was put on its balance sheet.

Apart from reducing net leverage, UTZ also managed to complete the repricing of its $630 million term loan. This action reduced the interest rate by 0.36%. As a result of these debt repayments and the lowering of the interest rate, it is expected that these actions, combined, will reduce FY2024’s interest expense by approximately $14 million.

Disposals Resulting in Strong Progress in Network Optimisation Strategy

Investors Relations

In 2024, UTZ disposed of a total of five of its manufacturing plants to Our Home. In 2021, there were 16 active manufacturing plants. To date, it has been reduced by 50% to 8 primary plants. Through these disposals, they have sped up UTZ’s network optimisation strategy and simplified executions as well.

The disposals allowed UTZ to leverage on fixed costs by allocating more volume to larger facilities. In addition, it also allows UTZ to increase its investment into its more scaled plants. Therefore, UTZ’s supply chain optimisation strategy is expected to drive growth and margin expansion moving forward.

Relative Valuation Model

Author’s Relative Valuation Model

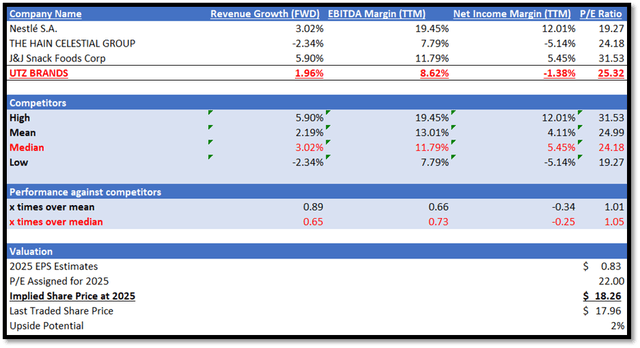

A brief background on UTZ before I begin. UTZ manufactures branded salty snacks. It operates in the packaged food and meat industry. In my relative valuation model, I will be comparing UTZ against its peers in terms of growth outlook and profitability margins. For growth outlook, I will be comparing their forward revenue growth rate, as it is a forward-looking metric. For profitability margins, I will be comparing their EBITDA margin TTM and net income margin TTM. EBITDA margin TTM measures core business activity performance, while net income margin TTM shows overall profitability. In addition, please take note that the P/E ratio in my model refers to forward non-GAAP P/E ratio. Non-GAAP P/E uses non-GAAP EPS.

In terms of growth outlook, UTZ underperformed its peers. UTZ has a forward revenue growth rate of 1.96% vs. peers’ median of 3.02%. Regarding profitability margins, UTZ also underperformed in both EBITDA margin TTM and net income margin TTM. UTZ has an EBITDA margin TTM of 8.62% vs. peers’ median of 11.79%. UTZ’s reported net income margin TTM of -1.38% is also lower than its peers’ median of 5.45%.

Currently, UTZ’s forward P/E ratio is trading above its peers’ median of 24.18x. Given its underperformance in both growth outlook and profitability margin, I argue that UTZ’s P/E should be lower than its peers’ median in order to reflect its underperformance. Therefore, I will be applying a discount to its peers’ median P/E, and this will form my 2025 target P/E for UTZ.

For 2024, the market revenue estimate for UTZ is $1.44 billion, while non-GAAP EPS is $0.71. For 2025, the revenue estimate is $1.49 billion, while non-GAAP EPS is $0.83. In its latest 1Q24 earnings, UTZ raised its adjusted EPS outlook from previous 16%–21% growth to 23%–28% growth. For 2023, UTZ’s reported adjusted EPS was $0.57, and if I apply the midpoint of its EPS growth rate guidance to that, the implied 2024 adjusted EPS is approximately $0.71, which is in line with the market’s estimate. Together, the management’s guidance and my forward-looking analysis as discussed support the market’s estimate. Therefore, by applying my 2025 target P/E to its 2025 EPS estimate, my 2025 target share price is $18.26.

Risk and Conclusion

The risk associated with my rating is in regard to its continuing efforts to reduce net leverage and its network optimisation strategy. By FY2025, UTZ’s net leverage is expected to be reduced to 3x, and less debt equates to lower interest expense. In addition, it has been consistently and actively disposing off business to speed up its network optimisation and execution simplification strategies. This strategy will allow UTZ to leverage on fixed costs, and it is expected to drive growth and margin expansion moving forward. Additionally, proceeds from the disposals are used to pay down its debt, further reducing interest expense. If these strategies were to bring in better than expected margin expansion, its current valuation might be able to hold its weight.

In its most recent 1Q24, its power brands, which make up 83% of total net sales, reported strong retail sales and volume growth. This implies that its core products are performing well. Apart from this, UTZ also utilised the net proceeds generated from its recent disposals, which are R.W. Garcia, Good Health, and five manufacturing facilities, to pay down its debt. For FY2024, its net leverage ratio is forecast to contract to 3.6x from FY2023’s 4.6x. By FY2025, it is expected to be reduced to 3x, cutting down its 3x net leverage target timeframe by one year.

In addition, these disposals will allow UTZ to leverage on fixed costs as it will be able to allocate more volume to larger facilities. All in all, these strategic initiatives are expected to drive growth and margin expansion moving forward. As a result, management raised its adjusted EPS growth guidance for FY2023. However, due to a lack of margin of safety in its current share price, I am recommending a hold rating for UTZ despite its strength.

Read the full article here