Canadian Net REIT doesn’t own this particular building, but it’s an example of what it owns in its portfolio

Canadian Net REIT (TSXV:NET.UN:CA) is a little-followed REIT trading on the TSX Venture Exchange which offers a compelling growth path, highly successful business model, attractive valuation, and a generous dividend while you wait.

(All figures in CAD unless indicated otherwise)

Introduction

Canadian Net REIT debuted on the TSX Venture Exchange back in 2011, when it raised $15M to help it fund the acquisition of five grocery store properties in Eastern Canada. It was originally called Fronsac REIT but changed to its current name in 2021.

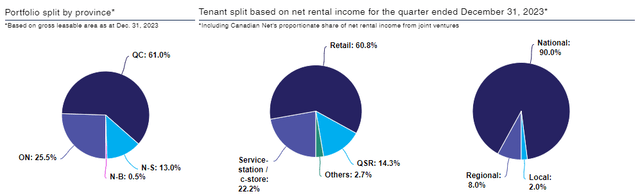

The company has grown significantly since its IPO and now owns 98 different properties. It operates in Eastern Canada exclusively, with approximately 60% of its gross leasable area coming from assets in its home province of Quebec. It also owns significant assets in Ontario and Nova Scotia, with 26% and 13% of its gross leasable area located in those provinces, respectively.

The portfolio mostly consists of real estate that is leased to large national retailers in Canada, household names like Walmart, Loblaw, and Metro. Approximately 60% of the company’s net rental income comes from these sources. It also owns gas station and convenience store real estate, which accounts for an additional 22% of rent. Finally, it owns real estate that is leased to fast food chains like KFC, Tim Hortons, and A&W. This part of the business is responsible for approximately 15% of rents.

Here’s a quick snapshot of the business as it stood at the end of December 2023.

Canadian Net REIT portfolio page

And here’s a look at some of the company’s tenants, large established companies that represent a who’s who of Canadian business. Canadian Net focuses on blue chip tenants, eschewing higher returns that could be had renting to lower quality tenants.

Canadian Net REIT Q4 2023 Fact Sheet

The REIT’s occupancy rate has traditionally been one of the best out there. As it stands today, occupancy is 100%.

Canadian Net REIT exclusively owns triple net real estate, an operating model where the tenant is responsible for paying variable costs like insurance, maintenance, and property taxes. This is an excellent business model for a few different reasons:

- It delivers more stable and predictable cash flows

- There’s no need to hire additional staff to coordinate repairs, shop for cheaper insurance, or argue property taxes

- The company can grow while overhead stays largely the same

- New revenues are translated into earnings more quickly

The company focuses on properties that are in good locations along main streets in medium-to-large cities. It then leases them to tenants who benefit from being located in these prime locations, versus focusing on tenants who might be more concerned with keeping costs low. This translates into fewer tenant improvements needed to attract new renters, higher probabilities of lease renewals, and, ultimately, smoother cash flows.

Although investors might think Canadian Net’s small size (it has a market cap of approximately $100M and an enterprise value of about $270M) is a disadvantage, it does create some interesting opportunities. When it looks for acquisitions, the company’s sweet spot is in the $2M to $10M range — which is too big for individual investors but too small for other institutional investors. It’s a nice sweet spot that isn’t overly competitive.

The company sources various places for potential acquisition opportunities, including retailer sale/leaseback agreements, from private sellers, and occasional development opportunities.

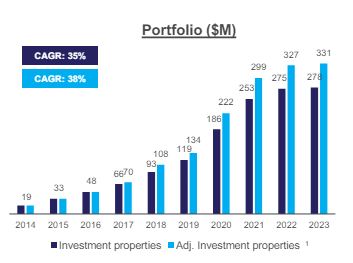

The growth strategy has been a winner over the last decade, with the portfolio growing by some 35% per year. We’ll note that portfolio growth has stalled over the last couple of years as interest rates have skyrocketed.

Canadian Net REIT Q4 2023 Fact Sheet

Astute investors should recognize Canadian Net’s business model. It’s very similar to Realty Income, which leveraged one Taco Bell property in Northridge, California into what eventually became a triple-net real estate behemoth with more than 15,000 properties across the United States and Europe.

There’s no guarantee Canadian Net REIT can replicate that success, of course. But the triple net real estate model is a powerful growth mechanism, and the Realty Income comparison is evidence of the long-term wealth it can create for shareholders.

Investment thesis

Canadian Net REIT offers investors an opportunity to invest in a REIT with a demonstrated history of growing funds from operations (FFO) on a per share basis at a compelling valuation.

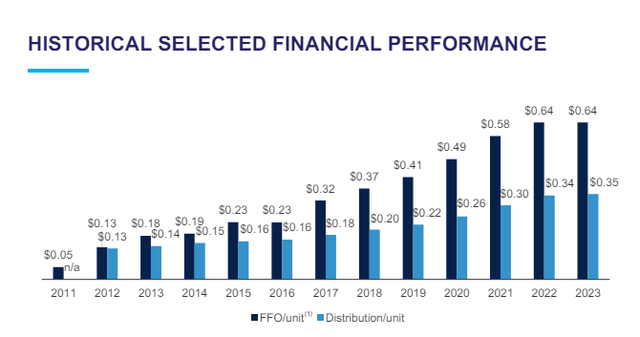

Let’s first look at the company’s history of growing FFO on a per unit basis. Many other REITs have spotty records here, issuing equity to make acquisitions that simply don’t move the bottom line on a per share basis.

Canadian Net earned $0.13 per unit in FFO in 2012. It earned $0.635 per unit in 2023. That’s a CAGR of 16%.

Canadian Net REIT Q1 MD&A

Management is highly incentivized to grow earnings on a per unit basis because insiders own a substantial 16% of the company. That type of insider ownership is rare in the REIT world, and it creates an environment that helps maximize shareholder value.

The company has also made growing FFO and distributions on a per unit basis as integral part of its operating model. Everything it does comes back to growing FFO — and the distribution — on a per share basis.

Canadian Net REIT Q1 MD&A

FFO per share growth has slowed over the last couple of years, caused by a rise in interest rates. Although the company primarily finances properties using long-term fixed-rate mortgages, it does have a credit line that has a variable interest rate. Management helped offset the impact of the credit line’s variable rate by selling off a few non-core properties and using the proceeds to repay that debt. The company also plans to sell two properties that are secured with variable rate mortgages — this should be done sometime this year.

Canadian Net REIT is also getting central bank help on this front. The Bank of Canada cut rates by 25 basis points at its last meeting, and many investors expect further cuts in 2024.

Investors are getting Canadian Net REIT’s history of FFO/share growth and its high-quality triple net portfolio at a compelling valuation. Canadian Net earned $0.64 per share in FFO in 2023. According to Seeking Alpha’s earnings page, the four analysts who cover the stock believe FFO per share will dip a bit in 2024, falling to $0.62 per share, before increasing again to $0.65 per share in 2025.

This puts the company at an extremely attractive price-to-FFO ratio. It trades at less than 8x 2024’s projected FFO, with its price-to-FFO ratio falling to a projected 7.5x 2025’s FFO. That’s quite an attractive valuation, even if we don’t get any FFO growth in 2024.

This is cheaper than rival Canadian REITs like CT REIT, which trades at 10x projected 2024 FFO and SmartCentres REIT, which trades at 10.5x projected 2024 FFO. Both CT REIT and SmartCentres REIT do have a history of growing FFO per share, however, their growth is significantly lower than Canadian Net’s FFO growth of 16% per year.

Canadian Net REIT also offers one of the more attractive distributions in the Canadian REIT space. The current payout is $0.029 monthly per unit, or $0.35 per unit annually. That works out to a 7% yield, which is highly attractive to income investors.

The company also has an excellent history of hiking its distribution, increasing the payout by an average of 9.7% annually since 2012. Distribution growth has stalled lately as higher interest rates have slowed growth, but rates coming down should help here.

Unlike many REITs, which have payout ratios of close to 100% of FFO, Canadian Net offers a sustainable payout ratio of 54% of FFO. Investors don’t have to worry about this distribution; it’s safe.

Risks

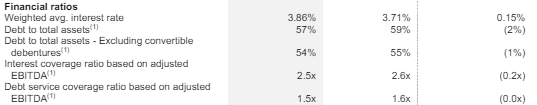

Canadian Net REIT’s main weakness is debt. The company has a 57% debt-to-assets ratio, which is a little higher than many investors like to see.

Canadian Net REIT Q1 MD&A

We’ll also note that the weighted average interest rate is creeping higher as the company is forced to refinance mortgages at a higher interest rate.

The good news is the debt ratios are coming down as the company sells non-core properties, and it has additional properties up for sale that should improve this even further. This will help on the debt front, as should additional Bank of Canada interest rate cuts.

The company has a diverse portfolio with operations across Eastern Canada, but the majority of its assets are located in Quebec. Thus, there is some local economy risk there — although its portfolio is strong and diverse enough it should weather even a severe recession.

The bottom line

Canadian Net REIT is an intriguing investment today. The stock is currently trading for $4.85 per share, which is a 40%+ drawdown from all-time highs set in 2021. It trades at a significant discount to book value, which was $6.29 per share at the end of Q1. And it trades at less than 8x 2024’s expected FFO.

It is trading like a deep value stock with zero growth potential. But management has grown the company significantly over the last decade, even on a per unit basis. There’s no reason to believe growth won’t pick back up again once Canada gets a few more rate cuts and potential deals make sense.

As a shareholder, I’m grateful Canadian Net’s management is taking the disciplined approach. The company can continue to pay down debt until there are better acquisition opportunities out there.

In the meantime, I’m happy to sit back, relax, and collect my generous distribution.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here