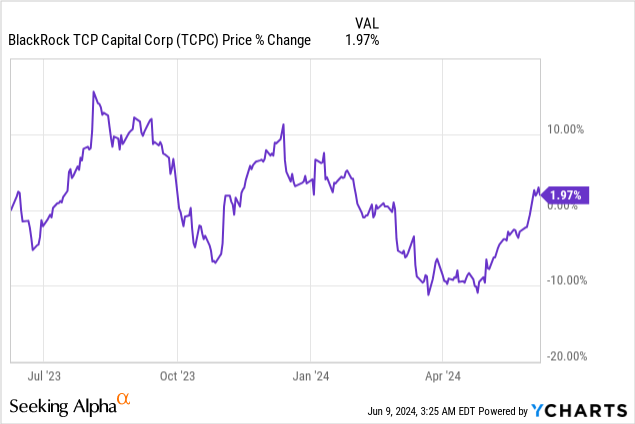

BlackRock TCP Capital (NASDAQ:TCPC) completed the acquisition of BlackRock Capital Investment in the first-quarter, which has generated a larger, more diversified BDC that is now running a distinct first lien strategy. The company’s shares traded well below book value before the merger, and its strong Q1’24 earnings (especially with regard to distribution coverage) pushed shares of TCPC into a new up-leg. Considering that shares have seen a rather significant revaluation to the upside after first-quarter earnings, I believe BlackRock TCP Capital has limited upside potential in FY 2024.

Previous rating

I rated shares of BlackRock Capital Investment a buy way before the merger with BlackRock TCP Capital, chiefly because the BDC focused more heavily on higher-quality debt investments, like first liens. In my last work on BlackRock Capital Investment, in December 2023, I specifically said that the merger between those two BDCs could result in a narrowing of the gap between share price and net asset value as investors valued the improved diversification and synergy potential: 10.2% Yield And A Merger Catalyst. With shares of TCPC now trading above net asset value and having a high non-accrual percentage, I believe BlackRock Capital Investment is a hold only.

A solid 12% yield, but likely limited revaluation potential following merger completion

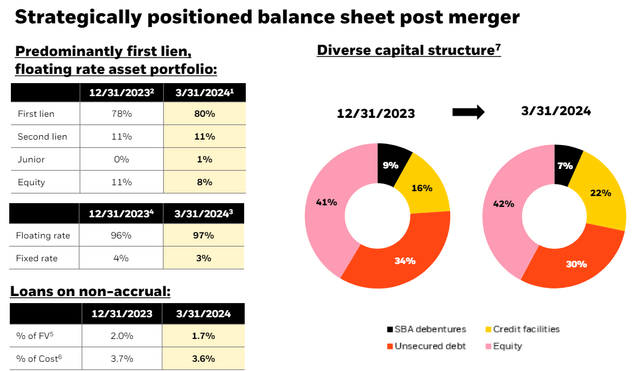

After absorbing BlackRock Capital Investment, BlackRock TCP Capital is now managing a $2.1B investment portfolio that is overly comprised of first and second liens. First liens had an investment share of 80% at the end of the March quarter and therefore dominated TCPC’s portfolio structure. Second liens were responsible for another 11% of investments, so the total secured lending percentage comes out to approximately 91%. BlackRock TCP Capital is also overly focused on variable rate loans, which makes TCPC a bit of a rate-sensitive bet for dividend investors. I believe the Federal Reserve is going to start lowering the Federal Fund rate in July, which would disadvantage those BDCs that are overly investing in variable rate loans.

TCPC

BlackRock TCP Capital has a relatively high non-accrual percentage of 1.7% as of the end of March 2024, but the percentage is down slightly from 2.0% at the end of FY 2023. A BDC with this high a non-accrual ratio should not trade at a premium to net asset value, in my opinion, and the non-accrual ratio is the main reason for my hold rating. The non-accrual percentage combined with a high variable rate investment share is why I see limited upside potential for TCPC in FY 2024.

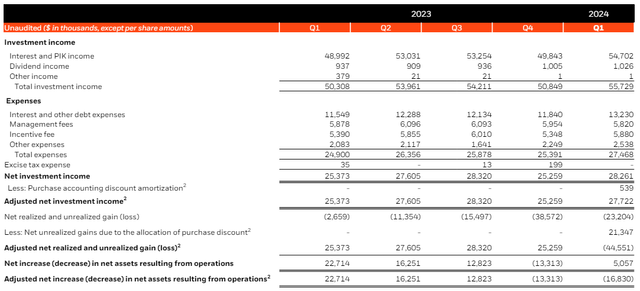

NII and distribution coverage

BlackRock TCP Capital is still growing its net investment income, which is set to change, in my opinion, in the second half of the year. The Federal Reserve is under growing pressure to cut the federal fund rate as inflation eases, which could remove a catalyst for the BDC’s net investment income growth. In Q1’24, TCPC generated $28.3 million in net investment income, showing 9% year-over-year growth. Almost all of this growth is attributable to higher interest income from TCPC’s variable rate investments.

TCPC

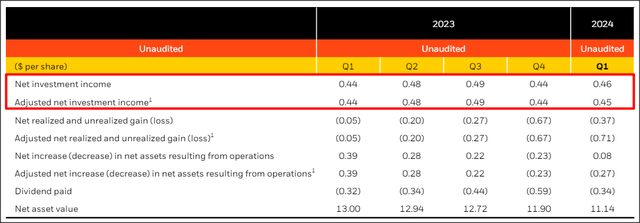

BlackRock TCP Capital consistently supported its dividend (pre-merger) with its net investment income and Q1’24 showed continual strength in this regard: TCPC generated $0.45 in net investment income, on an adjusted basis, which calculates to a distribution coverage ratio of 132%. In FY 2023, BlackRock TCP Capital posted a distribution coverage ratio of 138% and in the year before that of 125%. The increase in the distribution coverage ratio traces back to the BDC’s portfolio growth, but also its investments in variable rate loans, which boosted BlackRock TCP Capital’s net investment income growth during the Federal Reserve’s tightening cycle.

TCPC

BlackRock TCP Capital’s valuation

The BDC posted a net asset value of $11.14 per-share at the end of the March quarter, showing a 6% quarter-over-quarter drop-off, chiefly related to unrealized investment losses in the amount of $0.59 per-share.

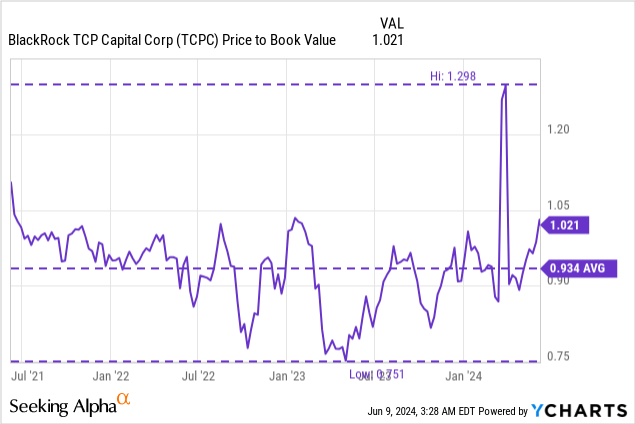

With a share price of $11.37, BlackRock TCP Capital is now trading at a 2% premium to net asset value, which is a major change compared to the company’s pre-merger history. The market clearly values the increased portfolio size, better diversification profile and strong distribution coverage post-merger, but that doesn’t mean that TCPC is a buy.

Since shares have revalued higher after the company’s Q1’24 earnings and are now trading at a premium to net asset value, as opposed to a pre-merger average 3-year price-to-NAV ratio of 0.93X, I believe TCPC has limited upside here, especially if the change in the rate trajectory and the company’s high non-accruals are considered as well. In my opinion, BlackRock TCP Capital could trade at 1.0X net asset value given that the BDC has healthy excess distribution coverage, but the non-accrual situation needs fixing. A 1.0X fair value price-to-NAV ratio implies a fair value of $11.14 per-share.

Risks with BlackRock TCP Capital

If BlackRock TCP Capital’s first lien portfolio were to perform poorly post-merger and the Federal Reserve were to change the interest rate landscape drastically and suddenly in July, TCPC is facing much weaker prospects for portfolio and NII growth. On the other hand, a higher for longer rate world and continual Fed accommodation could boost BlackRock TCP Capital’s NII and push the share price above 1.0X P/NAV for a longer period of time.

Closing thoughts

Shares of TCPC have surged since the company’s first-quarter earnings release. The BDC completed its acquisition of BlackRock Capital Investment in the first-quarter and the combined BDC is more diversified, has a stronger focus on first liens and the BlackRock TCP Capital generated very healthy distribution coverage in Q1’24… which is likely investors’ main concern when investing in BDCs. In my opinion, the distribution here is reasonably safe, but I also believe that BlackRock TCP Capital is likely already fairly valued here. With the BDC’s valuation exceeding its longer term pre-merger valuation average P/B ratio and a non-accrual ratio sitting just a bit below 2%, I believe BlackRock TCP Capital has limited upside, and I wouldn’t want to be a buyer here, despite the juicy yield.

Read the full article here