Investment Thesis: I revise my rating on Playa Hotels & Resorts from Hold to Buy.

In a previous article back in December, I made the argument that while Playa Hotels & Resorts (NASDAQ:PLYA) had seen encouraging growth in its average daily rate, occupancy pressures remained and that future growth would be dependent on the degree to which the company can improve RevPAR growth across its portfolios and reduce its net debt to EBITDA ratio.

Since my last article, the stock has seen a slight decline of just under 2%:

TradingView

The purpose of this article is to assess whether Playa Hotels & Resorts has the capacity for renewed upside from here – taking recent earnings performance into consideration.

Performance

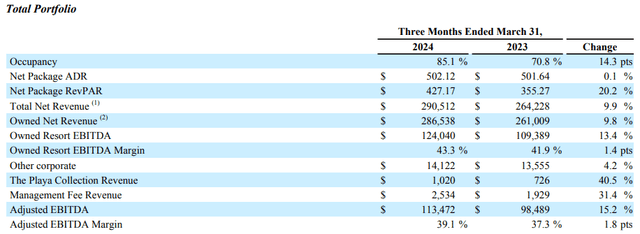

When looking at Q1 2024 earnings results (as released on May 6, 2024), we can see that across the total portfolio – occupancy is up significantly to 85.1% from 70.8% in the prior year quarter.

This resulted in an over 20% increase in net package RevPAR over the same period, even though net package ADR was up by just 0.1% over the same period.

Playa Hotels & Resorts: First Quarter 2024 Results

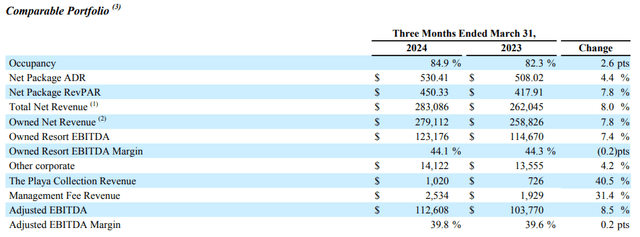

When looking at the comparable portfolio – which compares the performance of existing resorts across different time periods (in this case, excluding Jewel Palm Beach and Jewel Punta Cana), we can see that it was net package ADR once again that was driving growth – with the same up by 4.4% and occupancy up by 2.6%, and net package RevPAR up by 7.8%.

Playa Hotels & Resorts: First Quarter 2024 Results

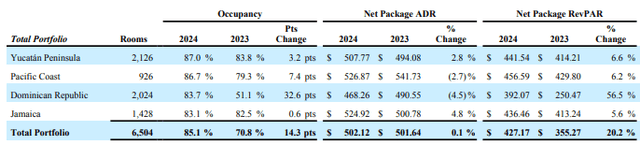

From a geographical standpoint, we see that the Dominican Republic showed the highest growth in RevPAR on a percentage basis and is the second-largest region by number of rooms in the portfolio. The region also saw a particularly strong improvement in occupancy – from 51.1% to 83.7%.

Playa Hotels & Resorts: First Quarter 2024 Results

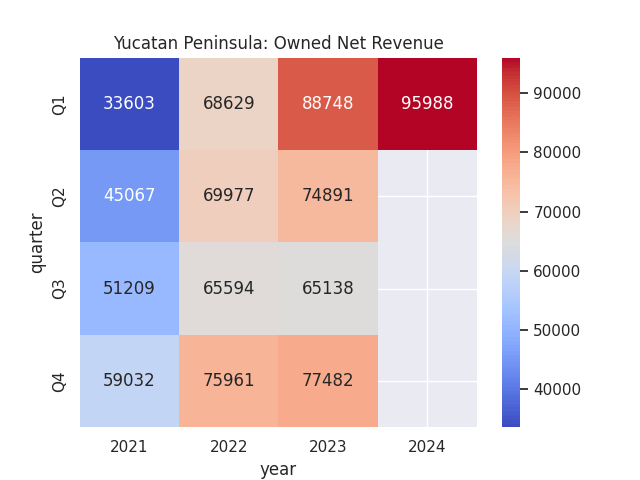

However, the Yucatan Peninsula is the largest by number of rooms and is also the largest in owned net revenue. Here is a breakdown of owned net revenue by quarter for the Yucatan Peninsula.

Figures (in thousands) sourced from Playa Hotels & Resorts historical earnings reports. Heatmap generated by author.

We see that owned net revenue is up by just over 8% as compared to the prior year quarter. Additionally, we see that for 2023 – every quarter (with the exception of Q3) showed an improvement in owned net revenue as compared to that of the prior year.

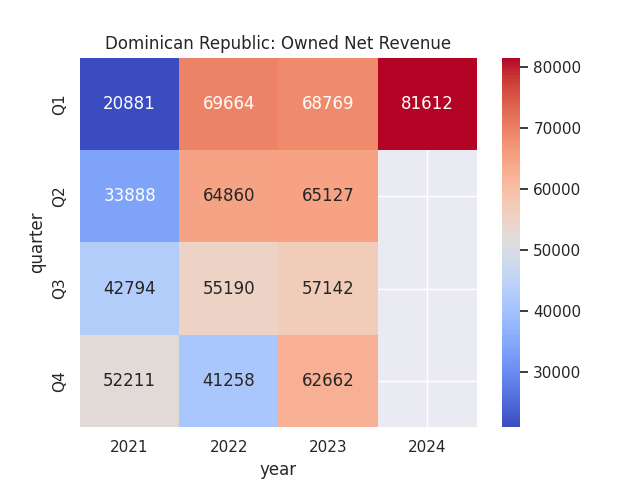

That said, the Dominican Republic has been showing a faster rate of growth in owned net revenue overall, with growth of 18% as compared to the prior year quarter. Here is a breakdown of owned net revenue by quarter for this region.

Figures (in thousands) sourced from Playa Hotels & Resorts historical earnings reports. Heatmap generated by author.

The fact that we have been seeing a faster rate of growth across the Dominican Republic has been encouraging. While the Yucatan Peninsula has shown higher net package RevPAR and a higher level of owned net revenue overall – we see that the rate of growth in revenue has been slower than that of the Dominican Republic.

Given the improvement in occupancy and RevPAR that we have seen across this region, this allows for Playa Hotels & Resorts to not be overly dependent on Yucatan Peninsula performance to drive overall revenue growth.

From a balance sheet standpoint, we see that the net debt to EBITDA ratio has seen a decrease over the past two years as well, which is encouraging and demonstrates that the company is continuing to bolster earnings without having to increase its net debt in order to fund such growth.

| Mar 2022 | Mar 2023 | Mar 2024 | |

| Net debt | 832 | 815.8 | 801 |

| Adjusted EBITDA | 76.9 | 98.5 | 113.5 |

| Net debt to adjusted EBITDA ratio | 10.82 | 8.28 | 7.06 |

Source: Figures sourced from historical Playa Hotels & Resorts earnings reports. Net debt to adjusted EBITDA ratio calculated by author.

Looking Forward and Risks

I had previously stated that in my view, further growth for Playa Hotels & Resorts would hinge on whether the company can 1) see a recovery in RevPAR growth across its Yucatan Peninsula and Pacific Coast portfolios, and 2) reduce its net debt to EBITDA ratio.

We see that this has been the case, and growth in RevPAR and occupancy across the Dominican Republic segment of the portfolio has been particularly impressive.

Going forward, I take the view that the Dominican Republic has the capacity to be a significant growth driver for the company more generally. Last year, ForwardKeys reported that the Dominican Republic was the highest-ranked top-tier destination by international arrivals and saw international visitor growth of 14% in 2023 as compared to 2019.

From this standpoint, the fact that Playa Hotels & Resorts has strong exposure to the Dominican Republic puts it in a great position to capitalise on growth across this market.

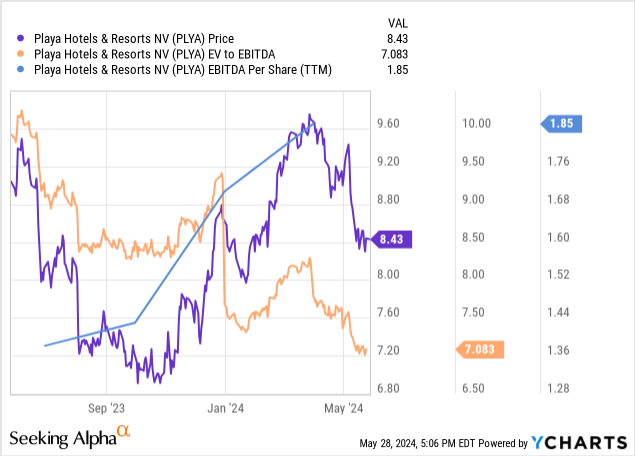

I had previously made the argument that Playa Hotels & Resorts was trading at fair value – on the basis that the EV to EBITDA ratio, EBITDA per share, and price were trading at similar levels to that seen in 2019.

However, we can see that since last December – both price and EV to EBITDA have fallen while EBITDA per share has continued to see growth.

YCharts

Given the encouraging growth that we have seen in revenues for the Dominican Republic and Yucatan Peninsula, as well as the 15.2% growth we have seen in adjusted EBITDA as compared to the prior year quarter, I take the view that the stock has the capacity to rebound in price to at least the prior high of $9.60, and potentially above the $10 level if earnings growth continues on the current trajectory.

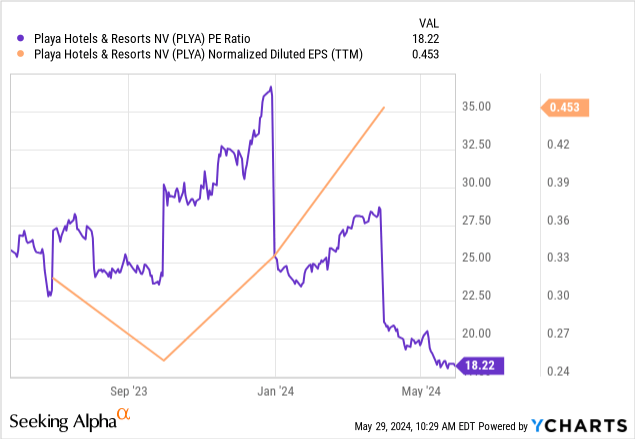

Over the past year, we also see that the P/E ratio has been descending while earnings per share have continued to climb – indicating that the stock is trading at a more attractive value on an earnings basis.

P/E Ratio

YCharts

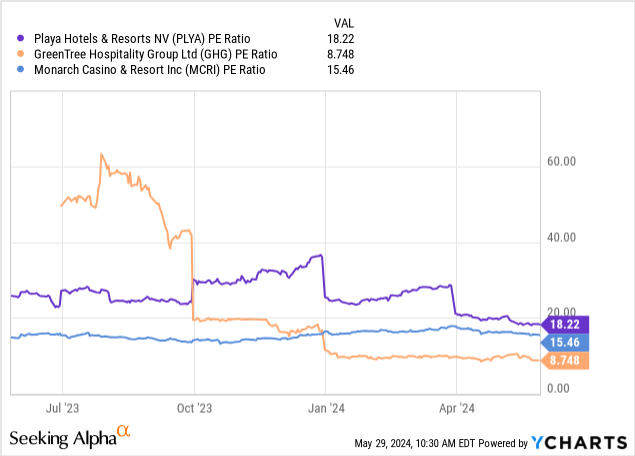

We also see that Playa Hotels and Resorts is trading at a higher P/E ratio as compared to peers GreenTree Hospitality Group (GHG) and Monarch Casino & Resort, Inc. (MCRI).

P/E Ratio Comparison

YCharts

However, I take the view that a higher P/E ratio relative to its peers is a reflection of higher investor confidence – with expectations of higher earnings growth for the stock as compared to its peers. Moreover, given that we have seen both the EV/EBITDA and P/E ratios decline in an absolute sense over the past year – I take the view that the stock is trading at a more attractive value relative to the previous year.

In terms of potential risks for the stock at this time, my view is that a potential plateau in growth across the Dominican Republic may be a hindrance to overall revenue growth in the short to medium-term. For instance, while we have seen strong growth across this market – we see that occupancy for the region has grown to 83.7% from 51.1% in the prior year quarter – which brings it in line with that of other regions.

From this standpoint, occupancy growth is at risk of plateauing, and we already saw that RevPAR growth was primarily driven by occupancy, whereas net package ADR fell by -4.5% as compared to the prior year quarter, which was the biggest drop of any region. In this regard, there is a risk that RevPAR growth could plateau if we see occupancy growth level off and the company does not have the capacity to raise prices further without seeing a slump in demand.

Conclusion

To conclude, Playa Hotels & Resorts has seen impressive revenue growth across the Dominican Republic, with that of the Yucatan Peninsula also remaining strong. While there is a risk that we could see a plateau in growth across the Dominican Republic, my view is that the company continues to remain on a good trajectory for overall revenue and earnings growth. In this regard, I revise my rating on Playa Hotels & Resorts from Hold to Buy.

Read the full article here