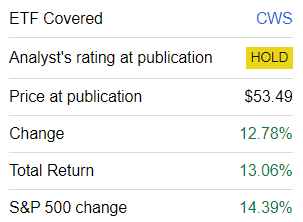

Today’s article is supposed to provide an updated analysis of the AdvisorShares Focused Equity ETF (NYSEARCA:CWS), an actively managed vehicle that I previously covered in August 2023. In the review, I would like to pay special attention to the changes its portfolio has undergone since then and how they have impacted the factor story, something investors should never ignore. Besides, I would like to discuss a few vulnerabilities that make CWS only a Hold, primarily on the performance front.

What is CWS?

CWS is an actively managed investment vehicle that was incepted in September 2016. The following brief description of the strategy is provided in the fact sheet:

CWS invests in fundamentally sound companies that have shown consistency in their financial results and demonstrated high earnings quality. The investment strategy has been employed by the portfolio manager, Eddy Elfenbein, since 2006 and is published annually as the Crossing Wall Street “Buy List.”

The core idea here is to create a minimalist, equally-weighted portfolio of the 25 most promising companies and adjust it only once a year.

What has changed in the CWS portfolio?

CWS has a low-turnover approach. However, it is obvious that stocks cannot be held ad infinitum. From the investment process document, we know that

Each year, CWS typically adds and deletes five names to the portfolio. At the start of the year, all the positions in the ETF are adjusted to be equally weighted. What causes a name to be dropped? It can be because the stock has soared to an untenable valuation. Other times, CWS will part ways with a position when the reason for owning it has changed. For example, it completes a major merger or spinoff.

As the Crossing Wall Street “Buy List” was adjusted, the CWS portfolio has been reconstituted as a consequence. More specifically, comparing the holdings dataset as of August 18 and April 15, I have noticed that the ETF has removed precisely five stocks, namely the following:

| Stock | Weight (as of August 18, 2023) | YTD price return (as of April 16, 2024) |

| Carrier Global Corporation (CARR) | 4.56% | -4.87% |

| Danaher (DHR) | 3.38% | 3.92% |

| The Middleby Corporation (MIDD) | 3.70% | -3.21% |

| Stepan (SCL) | 2.89% | -12.7% |

| Trex Company (TREX) | 5.68% | 8.04% |

Data from CWS and Seeking Alpha

It should be noted that SCL, one of the key players in the global surfactant market, now technically a small-cap due to its dismal share price performance, was one of the essential detractors from CWS’ performance in 2023, as it was down by 9.8% for the year, with issues on the demand side persisting into 2024 and the share price reflecting it. In the August article, I mentioned that SCL’s forward revenue growth rate was cut by 10.5%, which made it one of the most afflicted firms in the group of 17 that saw their growth prospects downsized since February 2023. At this juncture, SCL’s forward revenue growth rate is negative 2.3%. Another issue is Stepan’s free cash flow to equity, which has been negative since September 2021 owing mostly to an inventory build-up, which has been, in turn, the direct consequence of lackluster demand and soft sales. Even though SCL might look like a contrarian play now, I believe CWS’ decision to rotate out of this specialty chemicals industry name was rational and timely.

They have been replaced with the following five players:

| Symbol | Weight | YTD price return (2024) |

| Federal Agricultural Mortgage Corporation (AGM) | 3.7% | -6.8% |

| Amphenol (APH) | 4.4% | 13.2% |

| American Water Works Company (AWK) | 3.5% | -13.61% |

| McGrath RentCorp (MGRC) | 3.7% | -6.45% |

| Rollins (ROL) | 3.9% | -0.57% |

Data from CWS and Seeking Alpha. Price return data as of April 16

Most additions have been fairly timely, especially APH, one of the key players in the electrical components industry, with its robust return likely being driven by the AI narrative that has been bolstering IT names’ valuations. However, the addition of AWK, a water utility, is yet to contribute to CWS’ performance, as it is more of a disappointment for now, supposedly owing to the market’s rosy outlook for the economy, which resulted in the diminished attractiveness of expensive defensive stories.

Speaking of the shifts in factor exposures driven by these changes, it is worth illustrating them with the following table:

| Metric | August 2023 | April 2024 |

| Market Cap | $51.097 billion | $54.68 billion |

| EY | 4.42% | 4.87% |

| EPS Fwd | 6.26% | 8.68% |

| Revenue Fwd | 5.79% | 6.60% |

| P/S | 4.74 | 5.22 |

| Cash Flow/EV | 3.60% | 3.57% |

| ROA | 8.4% | 8.7% |

| Quant Valuation D+ or lower | 86.67% | 91.2% |

| Quant Profitability B- or better | 82.74% | 87.1% |

Calculated by the author using data from Seeking Alpha and the ETF

Overall, it can be deduced that CWS’ portfolio comprises expensive (as almost all the holdings have a D+ Quant Valuation rating or lower), high-quality companies with just average growth characteristics.

Remarks on performance

CWS has underperformed the S&P 500 index since my August article, even despite most of its holdings benefiting from the inflation-is-over narrative on the Street.

Seeking Alpha

More specifically, among the 20 stocks that were both in the August 2023 and April 2024 versions of the portfolio, just 3 delivered a negative price return (which I calculated using share prices as of August 21 and April 16).

Calculated by the author using data from Seeking Alpha and the ETF

The key detractors were Polaris (PII) and The Hershey Company (HSY). The key success story over the period, now accounting for 4.85% of CWS’ net assets, was Fair Isaac Corporation (FICO).

As to HSY, it was one of the top detractors from CWS’ total return in 2023 as the stock was down by 17.9%, thus being among the culprits for the ETF’s inability to beat the iShares Core S&P 500 ETF (IVV). However, it seems HSY is perceived by the fund as more of a turnaround story, so unlike SCL, it retained its place in the portfolio.

Conclusion

In sum, CWS has a high-conviction strategy with consistency and stability worth appreciating, as just five stocks have been replaced this year, in line with the Crossing Wall Street “Buy List” change. At the same time, the portfolio is heavy in top-quality stocks, with 68% of the net assets allocated to companies with an A (including A+ and A-) Quant Profitability rating or better. Does this make CWS a Buy? There are meaningful reasons to doubt that.

First, it is true that the “Buy List” beat the S&P 500 grossly in the past (assuming the 18-year compounded gain delivered in 2006–2023), yet this is not the case with the CWS ETF itself as it is still lagging the market. To corroborate, little has changed since the previous note, as over the October 2016–March 2024 period, CWS underperformed IVV by 85 bps in annualized return.

| Portfolio | CWS | IVV |

| Initial Balance | $10,000 | $10,000 |

| Final Balance | $26,125 | $27,635 |

| CAGR | 13.66% | 14.51% |

| Stdev | 17.08% | 16.33% |

| Best Year | 30.97% | 31.25% |

| Worst Year | -10.42% | -18.16% |

| Max. Drawdown | -22.96% | -23.93% |

| Sharpe Ratio | 0.73 | 0.8 |

| Sortino Ratio | 1.19 | 1.24 |

| Market Correlation | 0.91 | 1 |

| Downside Capture | 91.27% | 96.85% |

| Upside Capture | 93.38% | 100.25% |

Data from Portfolio Visualizer

To give a bit more color, CWS has trailed IVV every single year since 2016, except for 2022, when it beat the S&P 500 ETF by 7.74%. In 2024, it underperformed IVV in January and February but finished slightly ahead (by 21 bps) in March. So the only advantage I see here is that it did capture less downside during the 2022 bear market, as it was better prepared for the higher interest rate era.

Burdensome fees (now at 84 bps) are also not to be forgotten, even despite the ETF applying a fulcrum fee system, which means the expense ratio is directly connected to performance. So today, I am once again struggling to find a reason convincing enough to upgrade CWS to a Buy.

Read the full article here