Business Overview

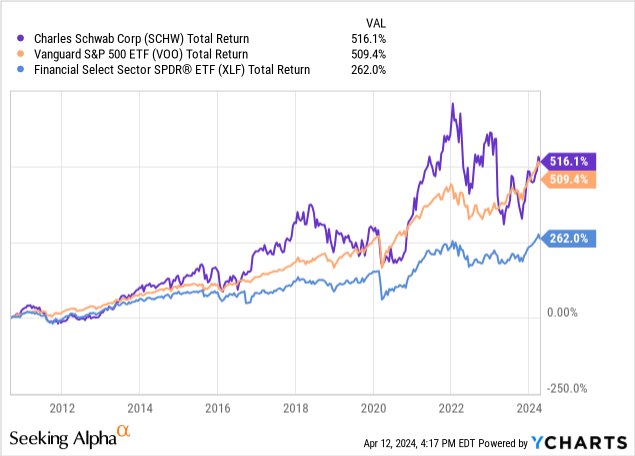

I initiated coverage of Charles Schwab (NYSE:SCHW) in August of 2023 with a Strong Buy rating at the price of $56.46. Schwab has outperformed the S&P since, posting a 25% total return vs. 16% from the index. Historically, Schwab has outperformed the wider index marginally and industry peers significantly:

Schwab is the third largest company in its sector by market cap and has the eighth best 10-year total return. The only other companies of comparable size with similar returns are Morgan Stanley (MS) and Goldman Sachs (GS).

Schwab is a powerhouse financial institution with a differentiated business model, one which pioneered commission free trading and was a fast follower to Vanguard with low-cost index investing. In October 2020, Schwab completed the acquisition of major competitor TD Ameritrade. Financial institutions will likely lean more heavily on acquisitions to drive AUM (Assets Under Management) growth in the future to continue driving market beating results. AUM growth will likely correlate with stock returns. Industry consolidation will be a defining characteristic of the financial industry in the future as larger players gobble up smaller competitors to inorganically boost AUM.

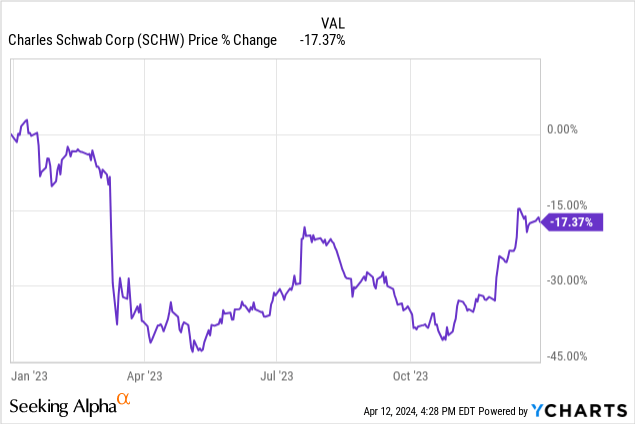

For much of 2023, Schwab was stymied by broken sentiment and an overwhelmingly negative rhetoric for financial stocks. At the onset of 2023, the Federal Reserve’s record setting pace of interest rate hikes was pressuring depository institutions indiscriminately, and the dramatic fall of Silicon Valley Bank in March of 2023 would add fuel to the fire for financial stocks.

While the SIVB story was one of risk mismanagement and over-concentration of a deposit base, sentiment across Wall Street quickly turned against regional banks and depository institutions as a whole. Schwab was hurt by this.

Schwab has posted market beating returns historically because it acts as a depository institution. It takes uninvested customer cash and sweeps it into interest bearing vehicles, using this net interest income to continue driving customer fees and ETF expenses lower. Schwab is distinctly different from a banking institution because its cash sweeps are from uninvested brokerage cash balances, not deposit account balances.

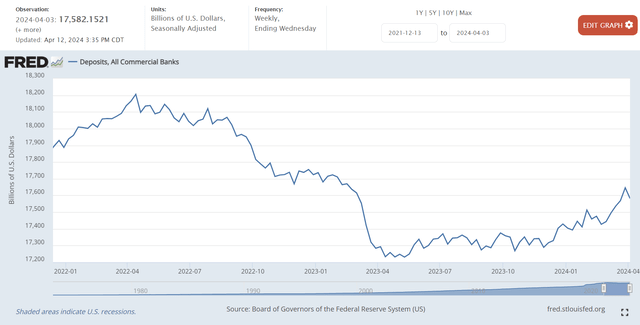

The banking industry as a whole suffered from a flight of deposits throughout 2023, a trend that has only recently begun reversing itself:

FRED

Banks record deposits as liabilities and use deposits to write loans, which are recorded as assets. The spread between deposit rates and lending rates becomes a banks NIM, net interest margin. As lending balances increase, NII or net interest income tends to increase as well. The issue for Schwab was not of deposit flight but of cash sorting. Customers were leaving less uninvested cash in brokerage accounts because government bonds became a much more lucrative investment. The recent equity market bull run, which started when the Fed began guiding for rate decreases in calendar 2024, exacerbated this issue.

This cash sorting hurt Schwab, but the company still managed to grow total interest and dividend income 31% year-over-year. Meanwhile, total revenues fell 11% because of a dramatic 332% rise in interest expense.

With that context, let’s delve into the upcoming report.

Earnings Preview: Fiscal Q1 2024

Schwab reports fiscal Q1 2024 earnings on April 15, 2024. Analysts expect Non-GAAP EPS of $0.74 and revenue of $4.72b for the quarter. Wall Street sentiment has been turning more negative recently though, with only two upward revisions to estimates versus 18 downward revisions to EPS estimates.

Meanwhile, analysts expect full-year 2024 Non-GAAP EPS of $3.41 and $4.33 for 2025. Schwab’s forward PE comes in at 20.73 for 2024 and 16.32 for 2025. Schwab’s five-year average forward PE is 18.88, so Schwab’s multiple has reverted back to the mean with recent price performance. My initial article called for this mean reversion – in the title itself I stated “Buy The Earnings Contraction.”

Now that a mean reversion has been achieved, the likelihood of future outperformance has decreased. Analysts still unanimously expect growth in the next few years, but the question at this point becomes whether this growth will beat the market or not. Revenue growth will be indelibly linked to two things: AUM growth and cash sorting. Let’s explore.

AUM Growth

As of Feb. 29 of this year, Schwab touts a massive 35.1 billion total brokerage accounts with $8.88 trillion in AUM. Core net new assets for the month of February reached $31.1 billion, bringing YoY AUM growth to 20% and MoM growth to 4%. The company expects modest revenue growth of 5%-6% in the upcoming quarter, with transactional sweep balances falling a bit but strong equity markets increasing trading activities and therefore income from trading fees. Overall, AUM growth is a big positive and illustrates Schwab’s core strength. With the TD Ameritrade acquisition in the rearview and most natural customer attrition squared away, Schwab is set to compound AUM reliably into the future. Its scale and trusted brand will allow for continued AUM growth, especially if equity markets remain strong.

Yet, cash sorting remains an issue.

Cash Sorting

In February of 2023, client cash as a percentage of client assets was 11.6% and is now down to 10.2% in February of 2024. This figure hasn’t grown since October of 2023, so an inflection here will be critical to Schwab’s stock returns. It represents an immense opportunity for or risk to future growth in interest income.

What drives cash sorting decisions by consumers?

First and foremost, interest rates. The Fed’s interest rate policy has a two-fold impact for Schwab: 1) It benefits the stock valuation generally as rates fall (as it does for equity markets generally), and 2) it benefits Schwab’s business model as customers will leave more uninvested cash as rates fall.

With rates as lucrative as 5.39% on 1-month Treasury bills, customers have a strong incentive against leaving uninvested cash in brokerage accounts. With the recent string of hot CPI prints, Seeking Alpha News Editor Liz Kiesche noted:

Interest rate traders are pulling back on bets that the Fed will start cutting rates in June. The probability that the federal funds rate will stay at 5.25%-5.50% increased to 73.2% on Wednesday, compared with a 42.6% probability on Tuesday, according to the CME FedWatch tool.

The longer rates stay elevated at current levels, the lower the likelihood of a cash sorting inflection. This has been a pesky and sustained headwind for Schwab’s net interest income as it leaves less cash to sweep to earn interest while interest expenses remain elevated. While Schwab’s Capital Markets revenue benefits from a strong equity market, the headwinds on net interest income may prove too strong to generate market beating returns in the short-to-medium term.

A higher-for-longer rate paradigm will make it difficult for Schwab stock to beat the market.

On top of that, a prolonged bull market could also pressure Schwab’s cash sorting issue. Retail investors are fickle; they are known to increase participation in equity markets during bull runs and pull out during bear markets. The longer a bull market runs, the more retail participation we can expect.

Schwab won’t be immune to this. If tech stocks continue running rampant, particularly semiconductor stocks, Schwab’s retail base may find it hard to fight the FOMO (fear of missing out) of equity investing. This could certainly keep the pressure on Schwab’s cash sorting issue well into the future.

Overall, I do not see any reliable data suggesting Schwab is out of the hot water with the cash sorting issue that pressured the stock in the first half of 2023. Therefore, I do not see any reason for additional purchases of Schwab stock with the cash sorting issue in its current state.

Investor Takeaway

While the wider equity market bull run has benefited the stock and caused a mean reversion in its PE, the fundamental issue remains that higher-for-longer rates will keep interest income contained with higher-for-longer interest expenses. This is a fundamental issue with Schwab’s future outlook and gives me no reason to believe Schwab will produce market beating returns in the foreseeable future.

On top of that, Schwab kept its quarterly dividend unchanged at $0.25 in the recent report, breaking a streak of annual dividend increases since 2021. It’s possible that Schwab could increase its dividend in the upcoming report, but given the cash sorting headwind I find that unlikely.

Therefore, I rate Schwab a Hold at the current price point of $70 and dividend yield of 1.42%. Nothing here screams of imminent collapse or drastic underperformance, rather AUM growth is overwhelmingly positive, so I do not recommend any selling. But investors ought to carefully monitor Schwab’s “client cash as a percentage of client assets,” provided in monthly business updates, to gauge the worthiness of additional purchases.

An inflection of this datapoint would materially change my thesis, but the current state of Schwab’s business makes the stock unattractive for additional purchases at this time. My thesis would be swayed by two fundamental changes, either: 1) A price decline back to the $50-$60 range, contracting PE back below historical averages, or 2) a sustained (3 or more months) inflection in client cash as a percentage of client assets.

If either of those two changes occur, I will revisit my thesis and likely upgrade Schwab to a Buy. At this time, I’m downgrading Schwab stock to a Hold rating for at least the next quarter.

Read the full article here