First Interstate BancSystem (NASDAQ:FIBK) is a bank based in Billings, Montana. Analyzing it at first glance the thing that most catches your eye is its high dividend yield of 7.10%. Anyway, after the release of Q4 2023 I personally begin to have doubts about its sustainability. This quarterly did not go well as NIM continues to decline and demand for credit remains sluggish. At the same time, the upward pressure on the cost of deposits continues.

I had already pointed out all these problems in my article on Q3 2023 and as of today they are not completely resolved. However, unlike the previous quarterly, today there seems to be some glimmer of light at least in the second half of 2024. Be that as it may, the guidance for the FY2024 remains negative, implying a rather underwhelming first half of 2024.

Loans and securities portfolio

First Interstate BancSystem, Inc. (FIBK) Q4 2023

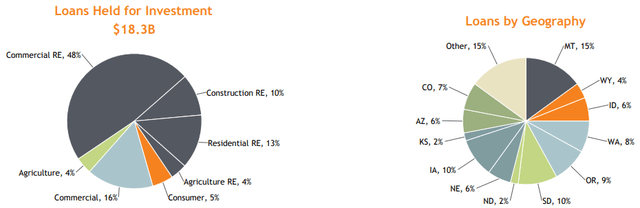

The loan portfolio reached $18.30 billion, an increase of only $66.30 million from the previous quarter: the decline in construction loans was offset by an increase in commercial real estate and agricultural loans. Compared to 2022, the loan portfolio increased by only 1%, highlighting a rather problematic situation regarding demand for credit.

First Interstate BancSystem, Inc. (FIBK) Q4 2023

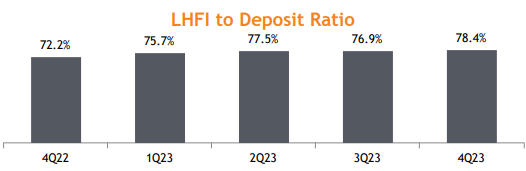

As can be seen from the low LTD ratio, FIBK has the financial flexibility and resources to issue new loans, but demand is still too sluggish. The new production rate is quite good, 7.80%, but if there are no households/businesses willing to take on debt, it will be difficult to improve the average loan yield. This stalemate may continue throughout 2024:

In the near term, we are still seeing some reluctance from potential borrowers, but expect this to change as economic conditions and the weather improves. Given that outlook, we are expecting total loan balance to be flat or up low single digits in 2024. However, given the strength of our balance sheet, if market demands increase, we’ll be able to respond quickly to additional growth opportunities.

CEO Kevin Riley

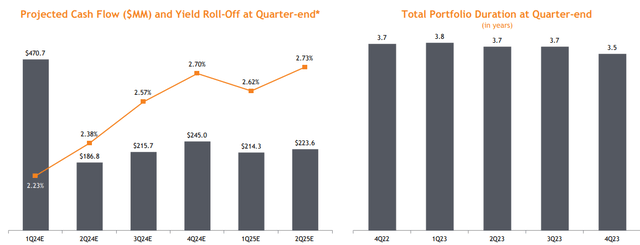

In other words, the bank has the liquidity to take advantage of opportunities, the problem is finding them. Since it is unlikely to change anything in terms of loan growth, the bank is shifting focus to the investment portfolio. After all, locking in current market rates by buying fixed-rate securities may be a good way to gain from future Fed Funds Rate decline.

First Interstate BancSystem, Inc. (FIBK) Q4 2023

In the next quarter, cash inflows generated by this portfolio will reach $470.70 million, by far the most profitable quarter until mid-2025. According to management expectations, proceeds are likely to be reinvested in fixed-rate securities, but much will depend on macroeconomic conditions in the coming quarters. In the event of a sharp decline in rates, some of the proceeds would either be used to reduce loans or kept on the balance sheet to face the seasonality of deposits. In other words, there is a willingness to increase this portfolio, but much will depend on how the situation evolves regarding market expectations for interest rates.

In Q4 2023, the securities portfolio experienced an increase of $162 million, mainly due to an improvement in fair value given the decline in Treasury yields. About $135 million of cash flows were reinvested in securities, yielding a weighted average return of 5.50%.

So, with stalled loans and reinvestment in securities at current market rates, average earning assets will also be flat in 2024. In short, on the asset side the situation is rather static, but as we will see on the liability side there is more dynamism.

Deposits and NIM

First Interstate BancSystem, Inc. (FIBK) Q4 2023

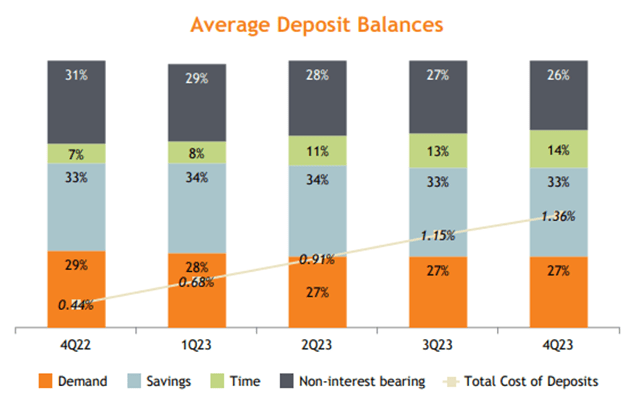

Total average deposits reached $23.32 billion, down a whopping $356.40 million from last quarter. The cost of total deposits increased but remains quite low: 1.36%. The composition of them has not changed much, and this decline was due to two factors:

- The first is a seasonal component that sees a reduction in checking account balances during Q4.

- The second relates to the runoff of high-cost retail CDs.

On the latter, I find myself rather in agreement with management’s choice. After all, FIBK has a high level of liquidity and does not need to pay high interest on deposits. The low LTD ratio may allow this bank to start unloading more expensive deposits.

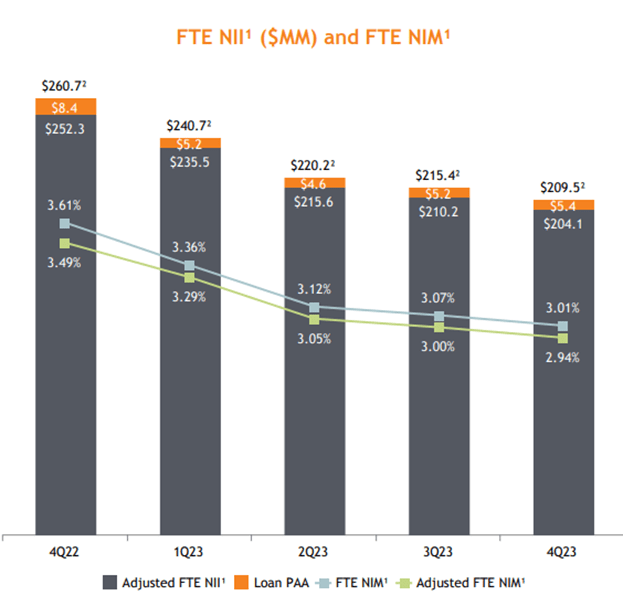

It is likely that continued upward pressure on the cost of deposits will continue in the coming quarters, bringing both NII and NIM even further down; by the second half of 2024 the tipping point is awaited and profitability may begin to improve.

First Interstate BancSystem, Inc. (FIBK) Q4 2023

This improvement will depend on a reduction in the cost of deposits rather than an improvement in asset returns. After all, time deposits have already been refinanced at current market rates, and the shift in customer mix toward higher-cost deposits has slowed.

CDs will play an important role in this, in fact 50% of them will mature by H1 2024, 90% by the end of 2024. In addition, 17% of deposits have a yield indexed to money market rates. The moment the Fed starts to reduce rates, the pressure of the cost of deposits will gradually vanish.

As for expectations on monetary policy, management expects 3 cuts of 25 basis points in 2024. Since FIBK is liability sensitive, the more cuts the more chance NIM will have to recover, especially if fixed-rate securities are purchased in these months. Should there be no cuts in 2024 (which is almost impossible), profitability should return to growth from H2 2024 onward anyway since the cost of deposits will not be able to increase much more.

Be that as it may, the recovery from mid-2024 onward will most likely not be enough to offset the decline in H1 2024. In fact, NII is expected to decline in mid-single-digit and NIM will also not improve. So, at least for the time being, the problem related to profitability and stagnant earnings remains.

Since this bank issues a huge dividend, in my opinion I have some doubts about the sustainability of it.

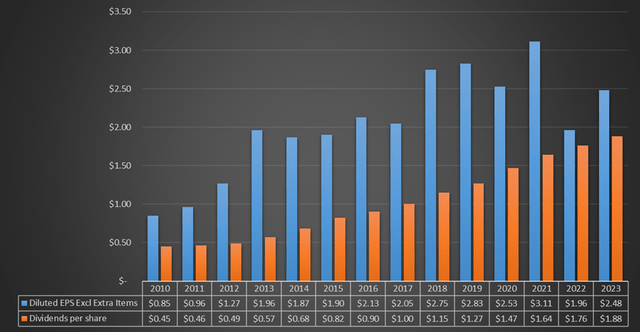

Chart based on SA data

The dividend continues to grow but EPS cannot keep up. With a declining NII in 2024, EPS could barely cover the dividend. This is not an optimal situation for those looking for a company with growing and widely sustainable dividends.

Conclusion

FIBK is a bank with a rather dynamic financial structure given the high liquidity on its balance sheet. However, sluggish demand for credit is creating quite a few problems for management, which is still hesitating on how to allocate available capital.

The cost of deposits is still a drag on the growth of both NII and NIM, but from H2 2024 something might change.

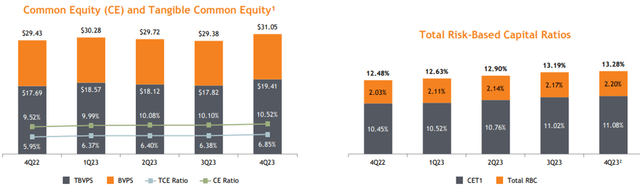

First Interstate BancSystem, Inc. (FIBK) Q4 2023

The bank remains well capitalized and the TVB per share reached $31.05, up 5.50% from last year. Finally, the 2024 EPS could slightly exceed the dividend issued, which is not an ideal situation for those looking for a dividend growth company. The current dividend yield is as high as it is risky.

Read the full article here