In the increasingly competitive realm of video game development, Take-Two Interactive (NASDAQ:TTWO) stands out as a true powerhouse. While Take-Two Interactive may not be as large as some of largest players in the industry, its flagship franchises are unrivaled in popularity and success. The upcoming release of GTA VI is sure to send shockwaves through the gaming community and could very well push Take-Two to new heights.

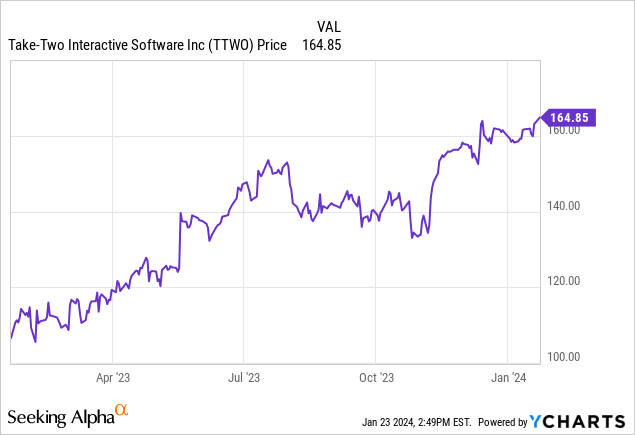

The anticipation for GTA 6 has likely contributed to the company’s recent upsurge.

The Unprecedented Hype of GTA

The Grand Theft Auto series has been the key component of Take-Two’s success. Each successive GTA release has grown exponentially in sales and pushed the boundaries of what is technologically possible in open-world gaming. The recent trailer of GTA 6 hints at an even greater leap in technological innovation even compared to groundbreaking past GTA titles like GTA 5.

The hype for GTA 6 is unlike anything the gaming industry has ever witnessed. In fact, the GTA 6 trailer broke several YouTube records, including the most-viewed new game trailer in YouTube history by racking up over 100 million views in 24 hours. To gain some perspective on how monumental this achievement is, the GTA 5 trailer, which broke records in its own right, only reached 100 million views a decade after its release.

Given how much the gaming market has expanded and how much better new gaming technology is, it would not be surprising to see GTA 6 blow past GTA 5’s lifetime revenues of ~$8 billion. If GTA 6 can achieve lifetime revenues of $20 billion, which is reasonable at this point given the games hype and the broadening gaming market, Take-Two should see its shares skyrocket.

The release of GTA 6 will be a cultural event, in which the gaming bench mark will likely be set for the next decade. The game’s anticipated innovations in AI, graphics, and gameplay will likely redefine what is possible in open-world gaming and help capture an even greater audience in the highly competitive open-world gaming space.

Rockstar Games

Robust Financials

Take-Two’s financial performance has remained strong, with the company reporting consistent revenue growth and robust margins. The company’s increasing broad portfolio, which includes names like Red Dead Redemption and NBA 2k, have contributed to the growing stability of the company’s financials. While GTA is still the clear flagship product for Take-Two, the company will likely become increasingly less reliant on it.

While the company’s Q2 GAAP net revenue decreased by 7% to $1.3 billion, this was largely a result of an impairment charge and amortization of acquired intangibles. The company is still expecting a full fiscal year net bookings of $5.45 billion-$5.55 billion, which is a figure that will likely increase dramatically upon the release of GTA 6 in 2025.

Large Risks Remain

Take-Two’s recent upward movement is likely driven by the anticipation for GTA 6. Given how much revenue GTA 6 is expected to generate, this is not surprising. However, this poses a big risk to investors if GTA 6 underperforms in any way as expectations of massive GTA 6 sales are already priced in to some degree. This means that Take-Two’s stock performance over the next few years will largely be dependent on GTA 6’s performance.

There is also the risk that leaks will continue to occur, which could result in a dampening of hype and development delays. Given the demand for insider knowledge and the fact that several major leaks have already occurred, this possibility is not out of the question. Any delays at this point will almost certainly put negative downward pressure on Take-Two’s stock.

Conclusion

Take-Two’s bullish outlook is anchored in the hype surrounding GTA 6, the company’s robust market position, and strong financial performance. The company’s strategy of investing in an increasingly diversified gaming portfolio and focusing on recurrent consumer spending have also helped maintain cash flow between major game releases. Although GTA 6 has been priced in to some degree, Take-Two still has more room to grow at its valuation of $28 billion.

Read the full article here