Impressive Qualities

The stock of the direct-to-consumer (DTC) beauty and wellness firm- Oddity Tech Limited (NASDAQ:ODD), hasn’t made a great deal of money for its shareholders since its listing in July this year, but that doesn’t necessarily mean that this is a bog-standard business; far from it.

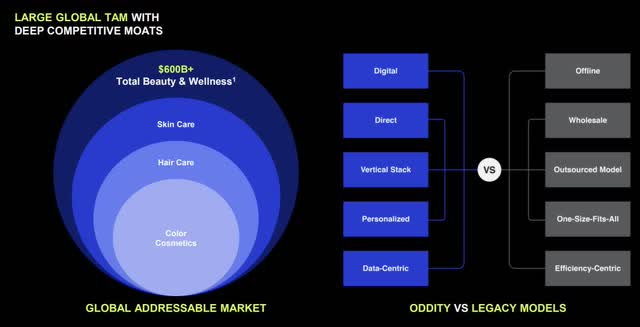

YCharts

In fact, if you’re looking to play the $600bn sized (source: Euromonitor) global beauty and wellness market, you could do a lot worse than ODD, which is in a good position to disrupt this predominantly offline-based market (only 20-25% of sales in beauty and personal care are online), whose progress is being weighed down by archaic strategies.

Investor Presentation

ODD’s main draw is that for a beauty and wellness company, it has a strong tech-based ethos running through it, with 40% of its workforce coming from this domain; essentially the folk at ODD harness AI, molecular discovery, computer vision, and data science to churn out high-performance beauty and wellness products that resonate with customers and lead to strong stickiness.

For context, note that the company’s skin and hair care brand- SpoiledChild, which was only launched last year, is now on course to hit $100m of net revenue by this year. The other major offering- the makeup portfolio of ODD- II Makiage has been largely instrumental in driving a 4-5x expansion in the group topline in recent years. Management now believes that both brands have the potential to hit $1bn in sales!

What’s also particularly key is that ODD’s tech-based consumer products and data-driven personalization strategies also appear to leave a lasting impression on its customer base, a large proportion of which keep coming back for more. Management pegs the repeat sales ratio at a whopping 50%, something which is unheard of in the consumer industry where tastes can be quite finicky and are largely promotion-induced. The repeat sales ratio isn’t a static figure and it has actually improved from the low-to-mid 40s level seen a couple of years ago.

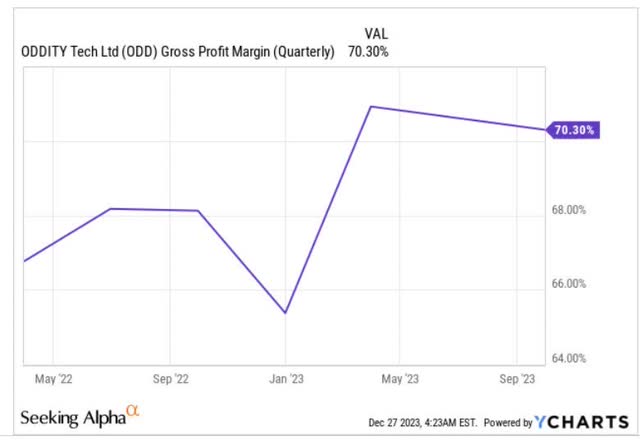

In fact that’s the other big highlight of ODD, in that, this is a consumer company that does not resort to any discounting whatsoever to gain volume, and all its products are sold at full price. Now, when you combine a full-price strategy with a high component of repeat sales (more repeat sales means fewer dollars need to be deployed by way of new customer acquisition costs), you inevitably get a company with a sturdy margin profile. In that regard, note how ODD’s gross margin profile has improved over time and is now at +70%.

YCharts

Note however as of March 2023, the company was converting around 10% of its 40m unique visitors to users, so there’s still work to be done to improve the conversion here. As the company continues to fine-tune its data-driven customer personalization strategies, and can churn out more effective molecules using AI (earlier this year, it acquired a biotech start-up Revela to deepen its impetus here) you could see it provide a more compelling proposition for wellness and beauty customers, driving even greater adoption. Brand 3 and Brand 4 of ODD are currently in the works and are expected to be launched in 2025, giving another leg up to this company’s impressive revenue profile.

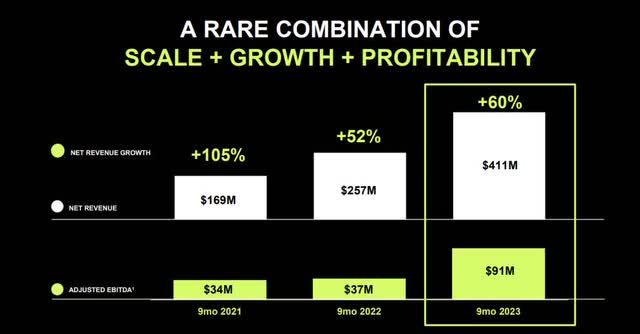

Q3 presentation

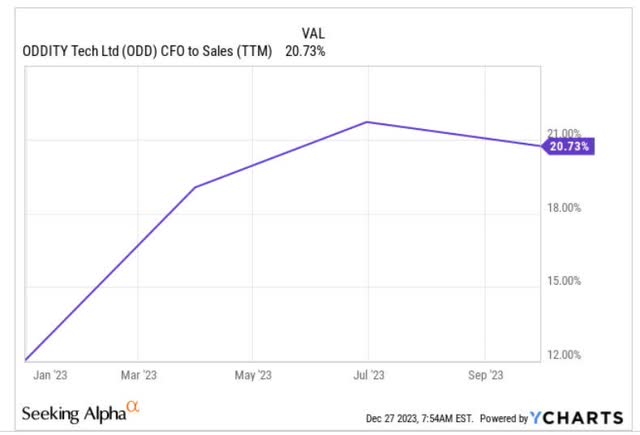

Quite unlike a lot of budding consumer companies that burn cash and only generate ample topline (mainly volume growth through discounting), note that ODD has also been generating EBITDA growth at an impressive pace (as of 9M23- 63% CAGR over the last two years). With solid flow through to the bottom line and tight working capital management, we have a business that is converting a greater chunk of its topline to operating cash flow. At the start of the year, it was in the early teens, now it is at +20% levels. Meanwhile, we’ve also seen the company’s liquidity balance swell by 5.7x to hit $164m, even as it shuns external debt.

YCharts

Closing Thoughts – Is Oddity A Good Stock To Buy Now?

The Oddity business, no doubt, has the support of a lot of positive levers, but commencing a long position in the stock at this point wouldn’t necessarily be the best use of resources.

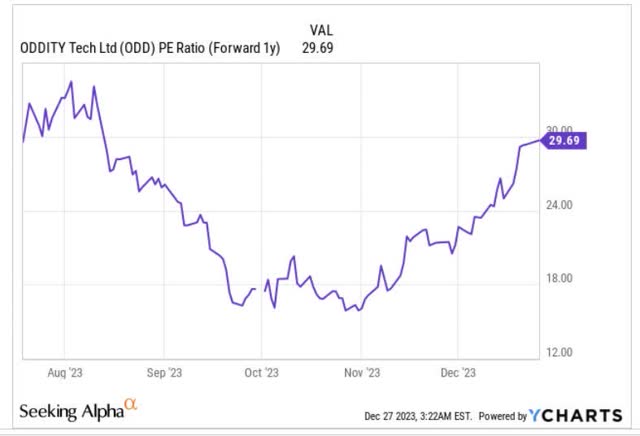

Firstly, forward valuations are a source of concern, even if you take into consideration the degree of medium-term earnings growth. A couple of months back, the ODD stock could be picked up at a forward P/E of a little over 15x, but since then we’ve seen a ferocious move where the multiple has almost doubled and is now not far from hitting 30x (based on the FY24 EPS).

YCharts

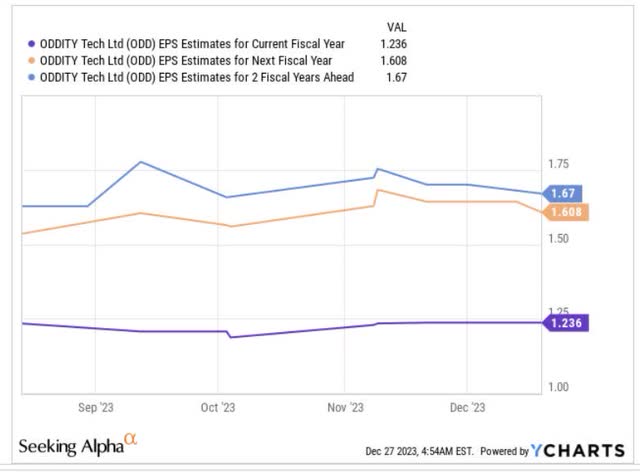

Now if ODD could keep up the degree of heightened earnings growth for the foreseeable future, one could perhaps make allowances for that multiple, but consensus estimates over a 2-year time frame suggest that earnings will come in at a much lower CAGR of 16% through FY25. For context, the diluted EPS CAGR between FY21 to FY23 will likely be well over 100% (based on management’s FY23 diluted EPS guidance of $1.21-$1.23).

YCharts

StockCharts

The chart above also suggests that bargain-hunters who specialize in rotating across different stocks within the Israeli terrain are unlikely to gravitate towards ODD at this point, as its relative strength ratio relative to the ISRA ETF is now trading around 18% higher than the mid-point of its trading range.

Then, if we look at ODD’s own daily charts, it’s very evident that in recent periods, the stock has been benefitting from some very strong momentum.

Investing

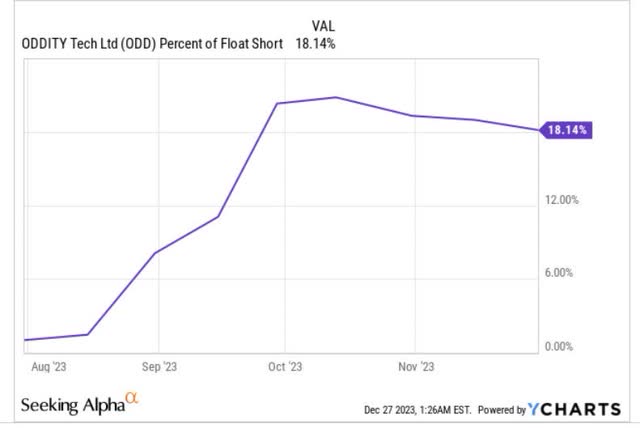

Since the second half of October, the stock has been trending up within a certain ascending channel, and bullish momentum was further validated when last month we saw the 20DMA overtake the 50DMA. Note that ODD’s float has a relatively high level of shorts (18%) who have been gradually trimming their positions since October. Admittedly, there’s potential for further momentum as these shorts cover their positions, but we would advise investors to not get carried away at this juncture as things are looking rather overextended.

YCharts

We say this because as things stand, the price is now trading well over the upper boundary of the channel, and the gap between the price and the 20DMA is the largest it’s been. Augmenting this, you also have the 14-period RSI indicator which is currently at overbought levels.

All these factors suggest that ODD isn’t a good BUY at these levels. A HOLD rating feels more appropriate.

Read the full article here