Introduction

Workday (NASDAQ:WDAY) is going to report Q3 ’24 earnings on the 28th of November ’23 after market close. I wanted to cover what the company is expecting to do in the quarter, give my thoughts on what I would like to see from the company, and some comments on the outlook. I covered the company back in June the first time I said the company’s growth prospects were promising, however, in the end, it was not enough to be worthy of an investment due to high stock-based compensation, which brought GAAP earnings considerably.

What has Happened Since the Last Coverage

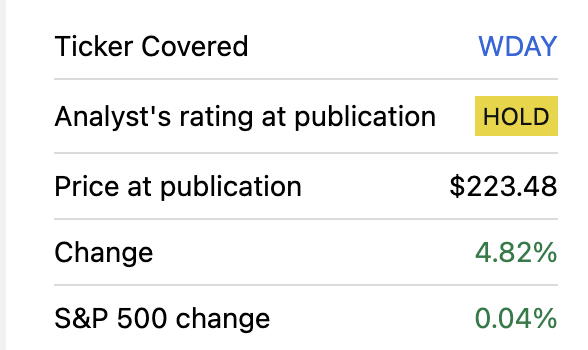

WDAY is up around 5% since my coverage back in June compared to flat for S&P500. In the article, I argued that even with such a nice growth outlook, it is not a good time to start a position as the risk/reward is not very enticing here, and if an investor would like to start a position in the company, a pullback would be preferred.

WDAY Performance since last coverage (Seeking Alpha)

Outlook

The company expects to do around $1.678B to $1.68B for the subscription segment of the business this upcoming quarter, which is around a 3% sequential increase and a 17% increase y/y. For the professional service, the company expects to make $165m, which is an increase of around 1% sequentially and a decrease of around 1% y/y, so we can see where the company’s outlook lays.

For the full year, the company raised its guidance to $6.579B for the subscription services segment and maintained the same guidance for professional services, which is in the range of $630m to $650m.

GAAP earnings per share is expected to come in at $0.22, while non-GAAP is expected to be $1.41.

Retention Rates and Backlog

I would be very surprised if we see retention rates worsen in the quarter. The company is known to have very strong retention rates as it offers a quality product that just cannot be easily replaced as can be witnessed by the company’s robust 24-month revenue backlog, which was up 23% since the previous quarter. The company has a good visibility of sales with such a backlog and expects to see an increase of 21% for the third quarter. Anything under that would be a little worrisome, especially if it comes in well below these expectations.

AI and ML Play

As with many companies that have some sort of relation to AI and ML, which are the buzzwords of 2023, they all say they’ve been using this technology for years, just to say that they’re not jumping on the bandwagon of AI. Let’s assume they have, so what have they been doing in this area and what is going to come of it in the future?

Right now, the company uses AI and ML to help organizations identify and develop the skills they need to succeed in the future. It helps to identify which skills are in high demand right now and tells which employees have the skills they need. The AI also helps to tailor the experience for each customer, making the process more efficient and helping employees to be more engaged and productive. AI also helps automate tasks such as payroll and expense management, which in turn saves time and effort. So, the company taking advantage of all the basic AI applications that we see in many other firms that claim to use AI and ML.

The company makes these AI and ML products available to all their customers free of charge, however, in the future, the company is looking for ways to monetize the products separately, which may be a good catalyst for the future. I would like to hear what the management’s strategy is for monetizing this product and am very curious to see how it will pan out because it is a very promising revenue generator in my opinion. In the latest transcript, the company said that it saw over 60% growth in customers who opted to share their data for their ML and AI models, so the demand is there.

Margins and SBC

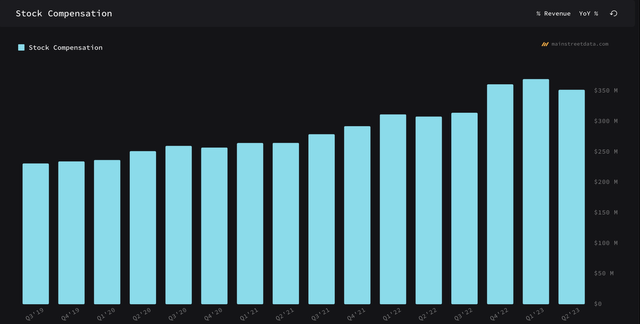

In my previous article, I said that I don’t like how the company depends so heavily on stock-based compensation, or SBC for short. I am pleased to see that SBC is coming down; however, it is not coming down nearly as quickly as I would have liked. So, I will be looking to see if the SBC decrease is accelerating in the upcoming quarter, or if will it still be rather high (I think it will be).

I am also very confused about how the company reports its operating margins, GAAP and non-GAAP. For example, in Q1 ’23, the company said that non-GAAP operating margins will come in at 22% while GAAP operating margins to come in “22 percentage points lower than non-GAAP”. This to me sounds like GAAP margins should have come in at 21.78%, which means that SBC is non-existent at this point, however, GAAP operating margins for Q2 came in at 2%. Please do correct me if I’m not understanding this verbiage correctly, as the same verbiage is used for the Q3 guidance where the management said non-GAAP operating margins will come in at 23.5% while GAAP operating margins will be 20 percentage points, or bps, lower.

This does not seem to be the case because if we look at Seeking Alpha’s expected numbers for Q3 GAAP EPS is $0.22 while non-GAAP came in at $1.41, so clearly the SBC is still prevalent. However, it has peaked in Q1 ’23 and is starting to come down. The management has always said that in the long run, SBC will not be as damaging to GAAP as it is now, so I expect non-GAAP to merge with GAAP numbers eventually.

Stock-based Compensation (Main Street Data)

Valuation

It has been a few months since my last coverage, so I have to update my valuation too. 10-year treasury yields went from 3.85% in my last coverage to around 4.4%, which reached around 5% a couple of weeks back.

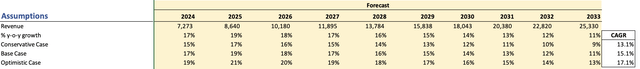

For revenue growth, I stuck with the same assumptions as I did before, which I think are reasonable yet conservative for some extra margin of safety. Below are those assumptions for the base, conservative, and optimistic cases.

Revenue Assumptions (Author)

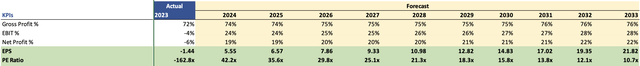

In terms of margins and EPS, I will be a little more optimistic and assume that SBC will have very little effect going forward, which is unreasonable, but I want to entertain the idea, so opted to use non-GAAP estimates (believe me, the outcome of the valuation is not going to change that much as you will see). Below are those assumptions.

Margins and EPS Assumptions (Author)

I also went with the company’s WACC of around 9.8% as the discount rate and 2.5% terminal growth rate for the DCF valuation. On top of these assumptions and estimates, I decided to add only a 15% margin of safety as the company’s balance sheet is still very strong, with lots of liquidity and a decent amount of debt that can easily covered by outstanding cash. With that said, WDAY’s intrinsic value and what I would be willing to pay for it is $138 a share, which means the company is trading at around 40% premium to its fair value.

Closing Comments

I have lowered my PT even further, which I think reflects my appetite for risk even more. The company is trading at a decent premium right now and I think it can be attributed to the company’s ability to grow at an amazing pace, however, I don’t think it is a good time to start a position here, therefore I maintain my hold rating until earnings improve dramatically or the shares pullback, if ever. The company’s outlook is very promising, especially in the AI and ML space; however, it is hard to put a number on what kind of revenue it will bring in and whether that will be another catalyst that could propel the company’s already outstanding revenue growth.

Read the full article here