Crown Holdings “Crown” (NYSE:CCK), with operations in beverage/food can and packaging manufacturing, has the business attributes that I generally seek out in an investable business. Some of those checkboxes include durability, defensibility, growth and an undemanding valuation. I originally purchased shares in November 2022 following the selloff related to its Q3 2022 report, which missed expectations on earnings and full year guidance over concerns related to inflation, energy prices, etc. Unfortunately, macro concerns are always going to present themselves, whether its in the form of customer demand, cost inputs, currency swings, etc. We can forecast macro all we want, but what really matters is management focusing on business operations and so should investors.

In the last few quarters, Crown has stabilized its sales by continuing to expand its production facilities worldwide and increasing organic volume production. In Sept. 2023, Crown’s investor presentation indicated that capex would be around $900 million, or a 7% increase relative to 2022, and about $2.55 billion cumulatively across 2021 through 2023. That’s to support infrastructure and topline growth. By 2024, that expect such spending to abate towards $500 million, which demonstrates that a good chunk is devoted to support growth and thereby signaling a fundamentally healthy business. That’s also a clear differentiation from other industries that are capital intensive.

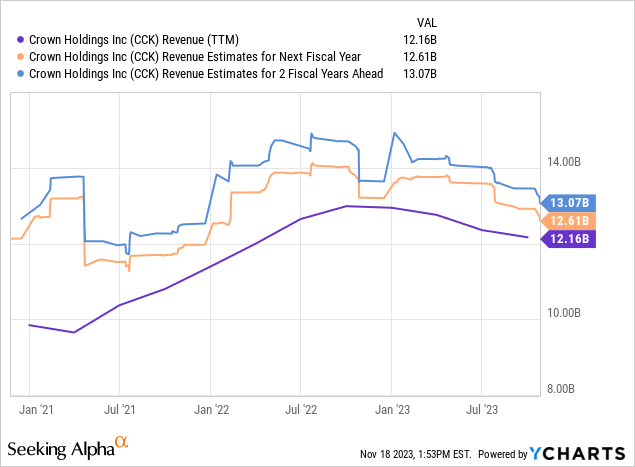

Although revenue estimates are moderating, secular growth is the consensus and time is on this company’s side from a sustainability perspective. Aluminum is infinitely recyclable, it’s more sustainable than plastic, cheaper relative to glass.

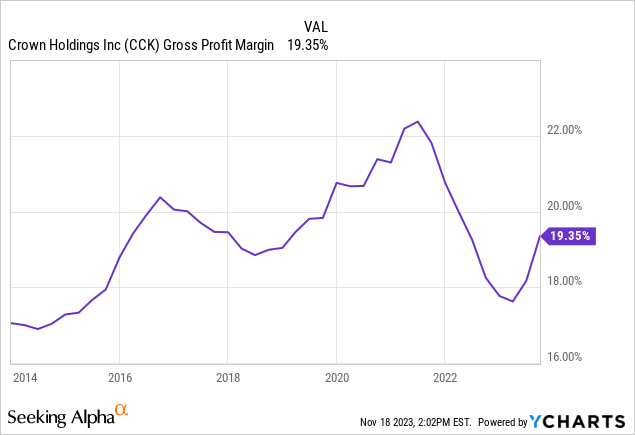

Turning to costs, Crown’s cost of raw materials in aluminum and steel have improved dramatically relative to the spikes we saw in 2022, which should enable gross margins to move back sustainably towards the 20+% range.

In the first 9 months of 2023, SG&A expenses relative to revenues were up by only 57 basis points, which is actually pretty good considering official inflation has been closer to 3%. So overall, Crown is doing a pretty good job on expense control. Part of that is related to cost reductions in their Transit Packaging segment, as disclosed in page 16 of their investor deck.

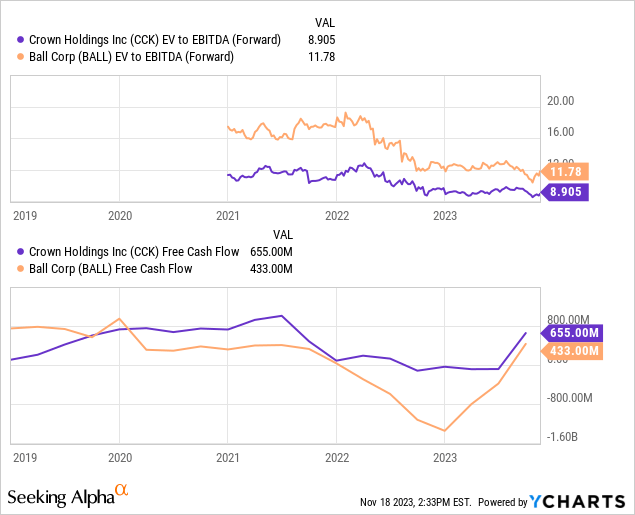

All in, Crown is pretty close, if not already, reached another all-time high on performance marks for EBITDA and operating cash flow. And once capex rolls down in 2024, a boon of $400 million, investors should expect incremental improve of their free cash flow profile.

Valuation, Capital Return, and SBC

Crown’s valuation is not exceptionally cheap, simply given the company’s size, scale, and excellent shareholder communication, but it’s certainly not expensive either. First, Crown is valued at ~14x forward earnings, which implies modest growth which is about on-par with the business today. However, when making a comparison with the S&P500, the mid-November forward earnings estimate measured at a P/E of 18.7x. I believe this comparison is reasonable given Crown’s historical and forecasted annual revenue and earnings growth rates are broadly similar to the S&P500. So we’re really looking at a 25% valuation discount to the S&P500.

An even better apples-to-apples comparison would be against industry peer Ball Corp. (BALL). Historically, Ball has garnered a premium valuation relative to Crown with superior growth and reinvestment patterns. However, that gap may begin narrowing as Crown has aggressively paid down debt in the last few years. Additionally, Crown may approach a more equivalent EV/EBITDA multiple as Ball given their comparable free cash flow profiles:

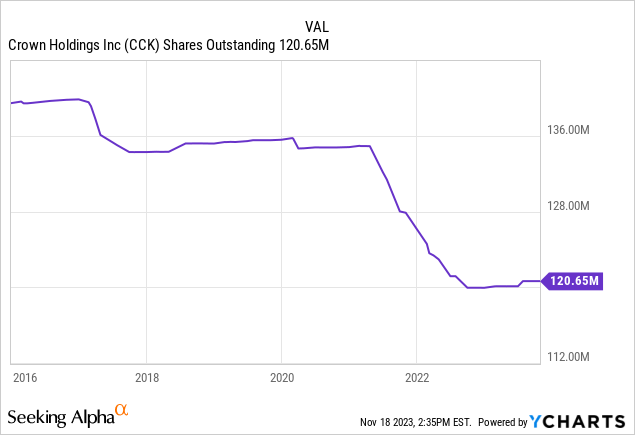

Not only has Crown paid down its debt, and will likely continue doing so to mitigate the effects of higher interest rates, but its also been gradually retiring shares. With its average cost of debt still only ~6%, even amid a higher rate environment, retiring shares is an effective way to return capital to shareholders.

In theory, if we hold operating cash flow steady at $1.4 billion and capex at $500 million against its $10 billion market cap, that’s a free cash flow yield of 9% at current prices. And of course that’s not even considering incremental profit growth in the years ahead. So, as long as shares remain at these underpriced levels, the intrinsic value to shareholders will keep rising at an accelerated pace with buybacks. Then one day, the market price should catchup.

Lastly, stock based compensation is only $36 million annualized in 2023. That’s a pretty small fraction of profits and free cash flow for being an industry leader and management’s overall performance. Considering all these dynamics, investors should take comfort in this level of shareholder stewardship.

Bottom Line

Crown is a steady growth business that continually cranks out profits and healthy free cash flows for shareholders. Of course, it the industry is intensely competitive and higher rates have crimped profitability. Macro forces could also present the risk of a lost year, like we saw in 2020. However, the valuation remains undemanding today and the lower the stock reprices, buybacks will become more accretive for shareholders. So for those reasons, I’m comfortable owning Crown shares as a core position within my portfolio. Thanks for reading.

Read the full article here