Investment Thesis

Foot Locker’s (NYSE:FL) business model is completely outdated. The company has no moat or pricing power and is simply a middle man distributor. The business revolves around being a one stop shoe shop and foot traffic. Both of these objectives for the company are seeing intense competition and change in the industry.

FL is facing competition from all sorts of different players from Amazon (AMZN) and DICK’S (DKS) to second hand private market sellers. Not to mention, not as many people are going to malls and shopping outlets. Millions of people prefer to shop online. They have all sorts of different products, every color or size offered, and you don’t have to leave the comfort of your home.

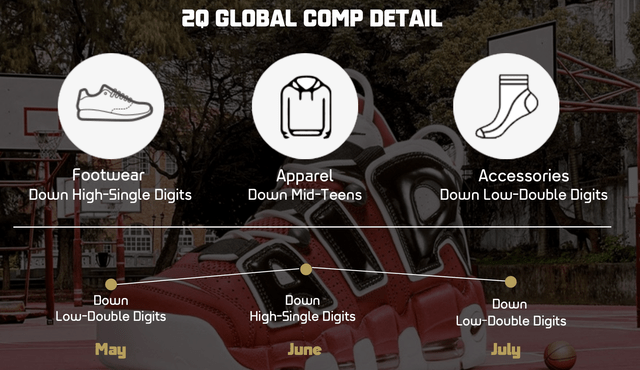

FL Q2 Comps (Foot Locker Investor Relations)

Demand is clearly slowing. Sales decreased by nearly 3% last year, and analysts expect sales to plunge over 9% this year. Competitors are gaining market share, and mall and outdoor shopping center traffic is declining. Foot Locker’s stock is down 40% year-to-date, and I believe there is still room for it to fall further. Things do not look good for management.

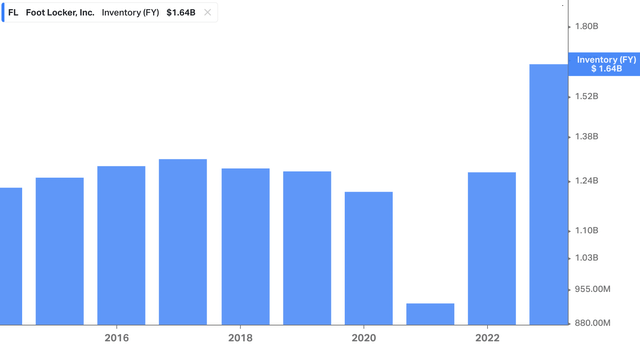

Inventory has also been increasing, nearly doubling since 2021, from $923 million to $1.64 billion at the end of the last fiscal year. This indicates that demand has slowed beyond the company’s expectations, resulting in aging and depreciating products on its shelves.

FL Inventory Level (Seeking Alpha)

Along with declining foot traffic at stores and the growing number of online options, Foot Locker faces rising costs that impact its pricing and margins. FL purchases its inventory from brands like Nike, Adidas, and Under Armour and must mark up the price of shoes to make a profit.

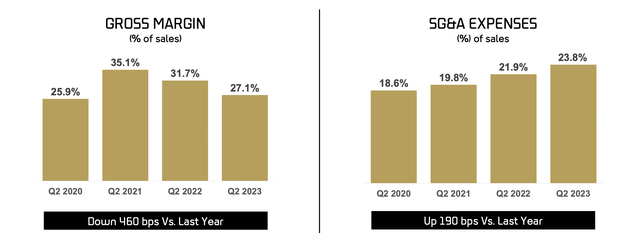

With recent spikes in inflation and input costs, FL’s operating costs have increased, lowering profits and margins. FL can only pass on price increases for so long before they become too high, driving customers to lower-priced competitors.

Gross, operating, and net income margins have all contracted and are well below the company’s 5 year average. I believe that Foot Locker will eventually lose market share to competitors. Major brands like Nike and Adidas will focus on direct-to-consumer (“DTC”) sales and sell excess inventory to lower-end retailers.

Overall, Foot Locker lacks direction and a clear future. Margins are shrinking, and there is little they can do about it because they don’t manufacture the products. They are caught in the middle, relying on other companies for their products. This gives them limited pricing power and flexibility, making them a company I would avoid investing in. Stay away from FL.

Fundamentals

To reiterate, the combination of slowing revenue and rising costs for Foot Locker is a concerning trend, explaining the stock’s 40% decline year-to-date. Margins are unlikely to hold up due to the company’s lack of pricing power, raising serious concerns. Without adequate margins or profits, cash flow will eventually dry up.

FL Margins & Expansions (Foot Locker Investor Relations)

Cash from operations (“CFO”) and free cash flow (“FCF”) have declined steadily since 2021. CFO plummeted from $1.06 billion in 2021 to a mere $173 million last year. Similarly, FCF nosedived from $903 million to a negative $112 million in the same period.

The company is heavily investing cash in attempts to expand its store network and boost brand awareness, but these efforts have yet to show affect. Foot Locker needs to establish its own brand identity, rather than solely relying on reselling big-name products and riding their coattails.

Champs, a brand owned by FL, has nudged the company in the right direction, but the progress is underwhelming. Foot Locker urgently needs to develop more original merchandise or risk being ousted from the market.

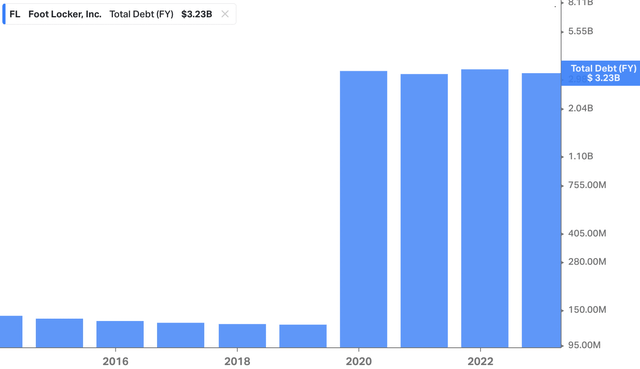

FL’s debt surpassed $3 billion in 2020, and the company has slowly been able to reduce it. The debt peaked at $3.5 billion and currently hovers just above $3 billion with a majority of it coming from long term store leases sitting just over $2 billion. Given the diminishing cash flow and the meager cash reserves being allocated to business growth and investment, I foresee no imminent reduction in debt levels.

FL Total Debt (Koyfin)

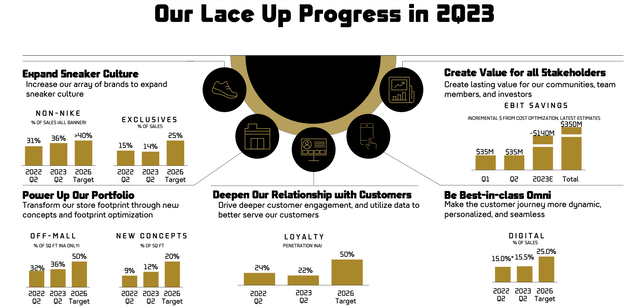

Don’t get me wrong, FL is actively pursuing a turnaround strategy. New CEO Mary Dillon, who successfully revitalized ULTA, is spearheading the effort. While Foot Locker has presented a tougher challenge, Dillon is determined to lead the company’s comeback. Attached below is Foot Locker’s overview of their new strategy, dubbed the “Laced Up” process. While the results are yet to be reflected on the balance sheet, the company is demonstrating adaptability in the face of an ever-changing industry.

FL Lace Up Process (Foot Locker Investor Relations)

Foot Locker is not going down without a fight. However, it may be too late to witness any significant turnaround in the business. The company is caught between suppliers and customers, trying to find a delicate balance. Trends may shift back in their favor, but for now, I am staying away from the stock.

Price Target and Valuation

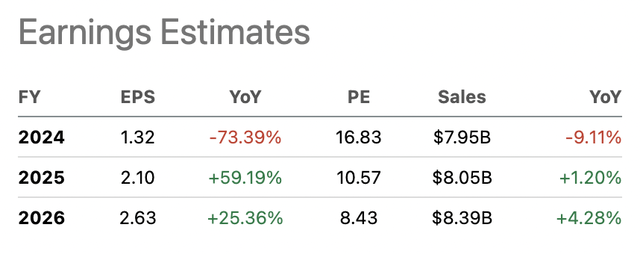

Foot Locker currently trades at a hefty price-to-earnings (“P/E”) ratio of 16.4x for this year, significantly exceeding its 5 year average P/E of 11.6x. The stock remains remarkably overvalued, particularly in light of analysts’ estimates projecting a 73% decline in earnings per share (EPS) this year and sluggish single-digit sales growth in the coming years. Given these factors, I anticipate a downward correction in Foot Locker’s stock price and a further contraction in its P/E ratio.

FL Analyst Estimates (Seeking Alpha)

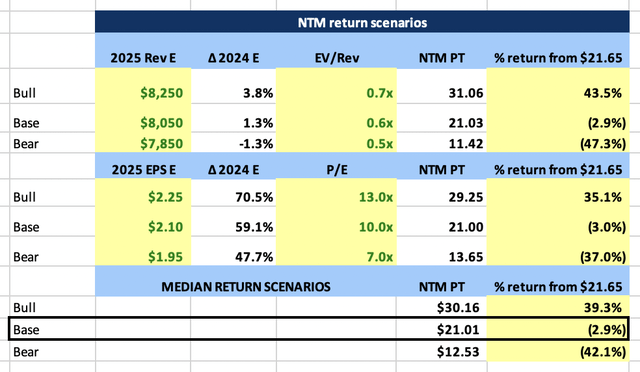

The company’s enterprise value to sales (“EV/S”) ratio provides a more reasonable valuation. Forward EV/S stands at 0.62x, below the 5 year average of 0.76x. With sales expected to slow down, I believe this represents a relatively fair valuation range, for the time being.

Utilizing analyst estimates and historical valuations, I have constructed a next twelve months (“NTM”) price target scenario table. Note, when calculating my EV/S price targets, I am counting store leases as debt. My calculations indicate that FL is currently trading 3% higher than my base case fair value, with a very low risk-to-reward ratio of 0.9x, well below our 3x target. This reinforces my Sell rating on FL as there is limited upside compared to the persistent downside potential.

FL NTM Price Target Scenario Table (Author Calculations Based on Analyst Estimates From Data on Koyfin)

Risk

My investment thesis has focused on the risks and challenges surrounding Foot Locker’s stock. Since I am recommending a sell rating, and some readers may short the stock, I want to address the possibility that the company could turn things around and succeed.

The primary risk when considering the company’s future is the rapid pace of change in the retail and fashion industry. With the influence of social media and influencers, customers are constantly adapting and gravitating towards the latest trending clothing and materials. The ‘cool’ or ‘what’s in’ options are constantly evolving, and Foot Locker will face this challenge as long as it exists. If they can innovate and offer new, trendy products, demand may return.

Sales and earnings are also both expected to decrease this coming year indicating the pull back in demand for Foot Locker products. Analyst believe sales and earnings will increase after this year, but that is a big if. We have already indicated what is slowing demand, so it’s up to management to see if they can innovate and offer new incentives to bring customers back.

The last risk to consider is the company’s ability to establish a stronger online presence. This would enhance their reach, profitability, and facilitate the sale of their entire inventory. I would expect FL to partner with a SaaS or advertising platform to better utilize and monetize their e-commerce business.

Conclusion

The Foot Locker brand is fading as brick-and-mortar shopping declines and online retail options proliferate. Inventory levels have surged, and the company’s financial growth has stalled.

Rising costs have eroded margins, running counter to shareholder expectations. Cash flow and cash reserves have dwindled as the company invests in its future, but the impact may materialize too late.

Given its valuations and the meager growth projected for the coming years, the stock still appears slightly overvalued. I believe FL has further downside potential and strongly advise investors to avoid the stock. There are numerous strong and diversified specialty retailers in the market; FL is not an essential holding for portfolios.

Read the full article here