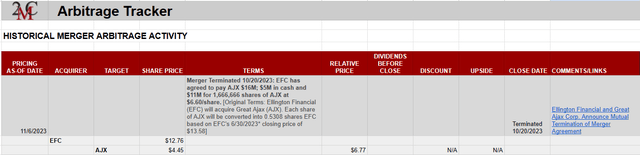

Portfolio Income Solutions maintains a live Arbitrage Tracker so we can monitor market pricing action and spot merger arbitrage opportunities in recently announced deals. The objective is to capture market inefficiencies and book a trading gain. We got pretty excited on October 30th by two pre-market mega deal announcements: Realty Income (O) would acquire Spirit Realty Capital (SRC) and Healthpeak Properties (PEAK) and Physicians Realty Trust (DOC) had negotiated a merger of equals.

As the Arbitrage Tracker describes, our elation quickly morphed to deflation as spreads for both mergers have remained extremely narrow.

Portfolio Income Solutions

Much has been written about the relative merits or disappointments in these mergers, but as exciting trading arbitrage opportunities there is really not much to see. Instead, we are drawn back to a previously announced deal that fell apart.

Revisiting a Broken Merger

On May 30th, Ellington Financial (EFC) announced a definitive agreement to acquire fellow mREIT, Arlington Asset Investment Corp. (AAIC); the transaction has yet to close, but we describe the terms of the deal here. Its acquisitive appetite apparently unsated, on July 3rd EFC announced it would merge with Great Ajax Corp. (NYSE:AJX).

Pursuant to the terms of the merger agreement, each share of AJX would be converted to 0.5308 shares of EFC. The objective of the arbitrage was to acquire AJX for a discount to the value of conversion to EFC and, unlike the SRC and DOC deals cited above, AJX and EFC were trading volume at nice 6% to 10% spreads. We got busy and flipped AXJ shares for small profits until August 29th when rising treasury yields were making us more cautious in the mREIT space.

On October 20th, without further explanation, Ellington announced that the merger with Great Ajax was terminated under mutual agreement. Under terms of the dissolution, EFC agreed to pay AJX $16MM, but that wasn’t enough consideration to keep Ajax shares from tumbling more than 35% the day after the announcement.

Portfolio Income Solutions

What Now?

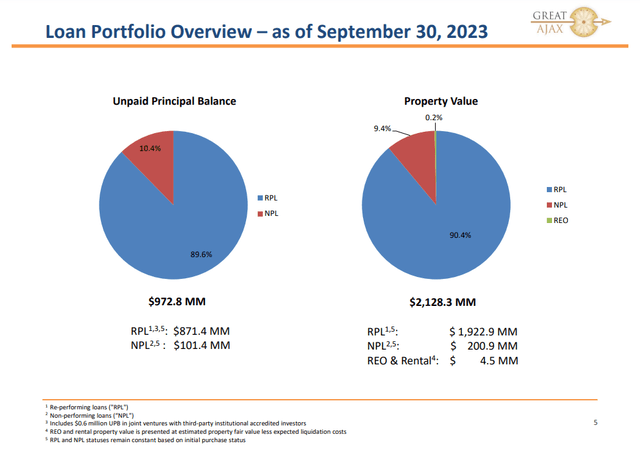

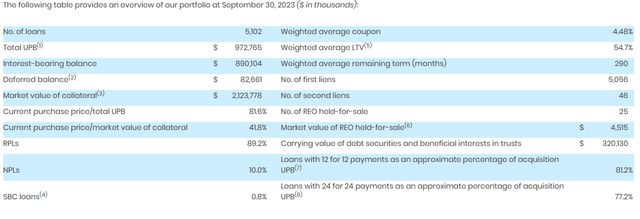

Single again, Great Ajax is a $115MM market cap mREIT that specializes in the acquisition and servicing of non-performing and re-performing residential mortgages. As of September 30th, the unpaid principal balance of their $973MM loan portfolio was collateralized by $2.1B of real estate.

AJX

On November 2nd, AJX reported an operating loss of $0.25/share and provided an overview of their consolidated loan portfolio as of 09/30/2023.

AJX

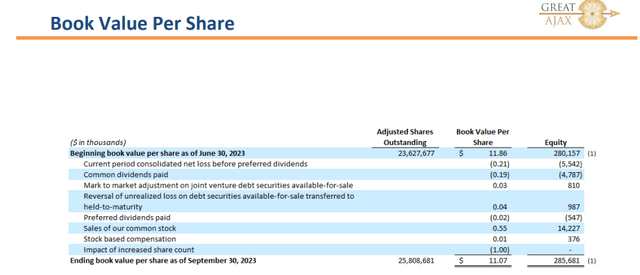

On the earnings call they described that the board had reduced the quarterly dividend from $0.20/share to $0.11/share. AJX’s 09/30/2023 per share book value was $11.07.

Additionally, they reiterated, but did not expand on, the terms of termination of the merger with Ellington Financial:

The termination was approved by both companies’ Boards of Directors after careful consideration of the proposed merger and the progress made towards completing the transaction. The details of the $16 million termination payment are disclosed in our press release last month. Ellington Financial holds approximately 6.1% of our stock, and it remains a securitization joint venture partner. Also, we disclosed in our earnings press release today, which I refer you to, and as part of our [indiscernible] regular assessment of our business and strategic direction, among other things, the Board engaged a financial adviser to assist us with thorough evaluation of strategic alternatives. We don’t intend to comment further on this process until disclosure is necessary or advisable.

The highlighted statement is the focus of this article and why Great Ajax might be worth revisiting.

Offer Price of $7.33

Terms of EFC’s July 3rd merger announcement implied an offer price of $7.33 for each AJX share. Measured against AJX’s 9/30 per share book value of $11.07, it would appear that Ellington walked away from a deeply discounted purchase. We don’t yet know why.

AJX

Today, AJX shares are changing hands in the $4.50 range, or about 41% of book value. Great Ajax makes its business in underperforming/nonperforming/distressed mortgages. Its structure is complicated by a variety of joint venture arrangements and is hard to value in the absence of comparables. EFC seemed to conclude that their proposed transaction had lost its appeal.

Buying a financial services company at 41% of book value implies 150% upside to liquidation. Buying shares at $4.50 implies an upside of 63% to the prior/failed $7.33 take-out price.

The earnings presentation’s final statement was that the company was still evaluating strategic alternatives. Translated to English, that means they are for sale.

They might not get the prior offer, but close is a long way up. We got long.

Read the full article here