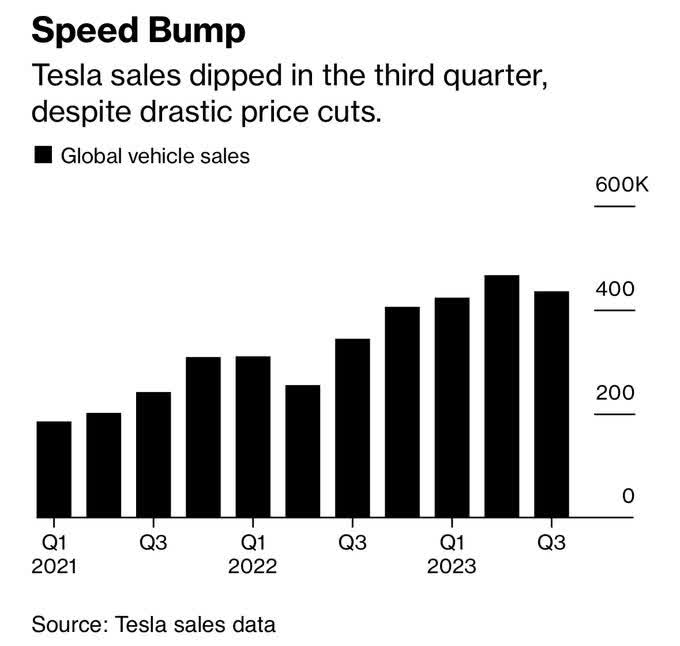

It’s a rough time in the EV auto space. Tesla (TSLA), specifically, has endured significant selling pressure following strong rallies earlier this year. Fundamentally, lower sticker prices for the firm’s vehicles is certainly a worrisome trend – and that is seen in softer quarterly sales trends. Still, a ‘volume over price’ strategy could be a long-term winning play.

Nevertheless, I am less bullish on TSLA’s near-term prospects based on the latest trends. Hence, I have a hold rating on the Direxion Daily TSLA Bull 1.5X Shares ETF (NASDAQ:TSLL), a leveraged long single-stock ETF I have covered this year.

Tesla Near-Term Headwind: Lower Price Tags

@dana_marlane, Bloomberg

According to Seeking Alpha, Tesla designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and storage systems in the United States, China, and internationally. It operates in two segments, Automotive, and Energy Generation and Storage.

The Texas-based $699 billion market cap Automobile Manufacturers industry company within the Consumer Discretionary sector trades at a high 71 trailing 12-month GAAP price-to-earnings ratio and the company does not pay a dividend. With earnings not due out until January, shares still trade with a lofty 46% implied volatility percentage while short interest on TSLA is rather low at 3.1% as of November 6, 2023. It’s key to have a rudimentary understanding of Tesla the company before diving into TSLL.

As always, it is imperative to recognize the risks associated with owning a leveraged ETF like TSLL. Long-term gains can be massive if a protracted trend takes place, but volatility and whippy price action generally hurt such ETPs. Thus, a fund like TSLL should only be used as a short-term trading vehicle, not as a long-term investment, and hence, this article is a near-term tactical outlook on TSLA. As I always caution, for a deeper understanding of the risks tied to leveraged ETFs, you can refer to authoritative bodies such as the SEC. More information can be found in the updated Investor Bulletin titled: Updated Investor Bulletin: Leveraged and Inverse ETFs.

According to the issuer, TSLL seeks daily investment results, before fees and expenses, that are 150% of the performance of the common shares of Tesla. Direxion highlights a major risk with TSLL:

Unlike traditional ETFs, or even other leveraged and/or inverse ETFs, these leveraged and/or inverse single-stock ETFs track the price of a single stock rather than an index, eliminating the benefits of diversification. Leveraged and inverse ETFs pursue daily leveraged investment objectives, which means they are riskier than alternatives which do not use leverage.

As I have previously stated: Here is an illustration of how negative compounding returns occur in a leveraged ETF: Suppose an index starts at 100, and the leveraged product also begins at 100. If the index rises by 10% to 110, the 1.5x long product increases to 115. However, if a subsequent 10% drop happens, the index falls to 99 (a 1% loss from the initial value). In contrast, the 1.5x long fund declines to $97.75 (0.85*115), reflecting a 2.25% decrease.

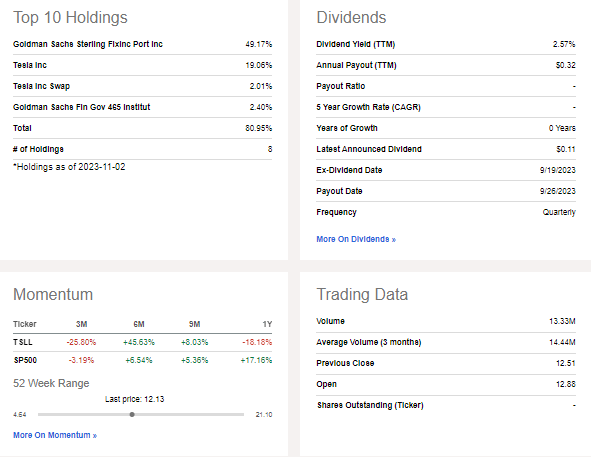

TSLL has lost some of its assets under management since August – that total now sums to just $851 million while the portfolio’s yield is 2.6%. Share-price momentum has also turned worse, earning the ETF a D- rating. With a high 1.08% annual expense ratio, it’s a fund that should not be held long enough for that fee to materially impact investors. TSLL also sports a poor F risk rating but liquidity is strong given average volume of more than 14 million shares.

TSLL: Portfolio Holdings, Weak Momentum Lately

Seeking Alpha

Looking ahead, corporate event data provided by Wall Street Horizon shows an unconfirmed Q4 2023 earnings date of Wednesday, January 24 AMC. Before that, the company issues Q4 2023 production data on the first trading day of the new year. Later this month, though, the firm’s management team is slated to present at the Macquarie International Equity Conference 2023 on November 29 and 30, which could bring about share-price volatility.

TSLA: Corporate Event Risk Calendar

Wall Street Horizon

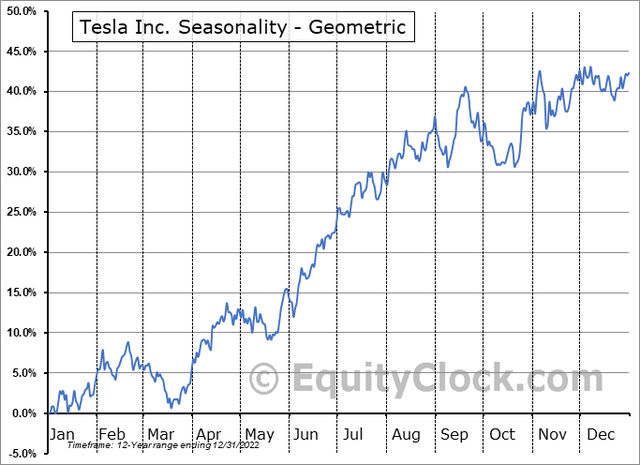

Seasonally, TSLA shares tend to consolidate between mid-September and mid-March, so this is actually a somewhat bearish part of the calendar, according to data from Equity Clock. The bright spot here, though, is that TSLA, on average, rallies 4.6% in November with a 67% positivity rate and 1.4% in December with a 58% positivity rate. Gains are better in January. So, it is a mixed bag on the seasonality front.

TSLA Seasonality: Neutral Trends Through Q1

Equity Clock

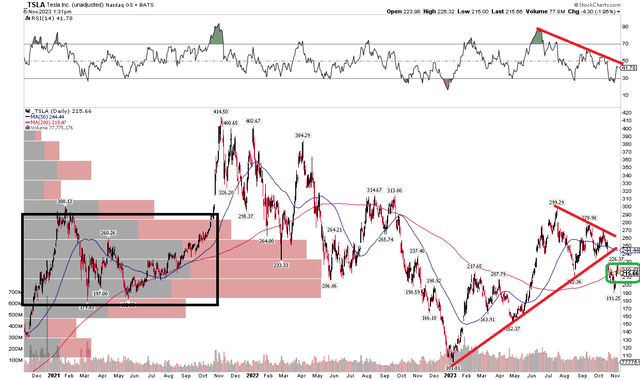

The Technical Take

TSLA’s chart has turned messy. Notice in the graph below that shares broke down from a symmetrical triangle that formed during the third quarter. The stock is on the mend after bottoming near noted resistance from my August look at the technical situation. With a rising long-term 200-day moving average, the broader trend is higher, but the nearer-term 50dma is in decline – yet another sign of a battle between the bulls and bears.

Further mucking up the trend analysis is an RSI momentum indicator that is trending lower off a high notched at the beginning of the second half. With high volume by price in the $180 to $290 zone, the current range might just be problematic for a levered fund like TSLL. While the underlying stock could move higher to fill a gap around the $240 mark, I am unimpressed when weighing all of the pieces of evidence.

Overall, the TSLA chart is mixed, causing me to lean against being long TSLL today. You can use the aforementioned price levels on the TSLA chart as guides when trading TSLL.

TSLA: Bearish RSI Trend, Upside Gap In-Play, Breakdown From A Triangle Pattern

Stockcharts.com

The Bottom Line

I have a hold recommendation on TSLL. The stock has bounced at times, offering favorable opportunities to play it from the long side, but momentum has weakened, and auto price cuts relayed to the marketplace don’t help the bulls’ cause. I would rather sit on the sidelines for now.

1) The Lowdown on Leveraged and Inverse Exchange-Traded Products (FINRA)

2) Leveraged and Inverse ETFs: Specialized Products with Extra Risks for Buy-and-Hold Investors (SEC)

3) FINRA’s Reminder on sales practices for Leveraged and Inverse ETFs (FINRA)

Read the full article here